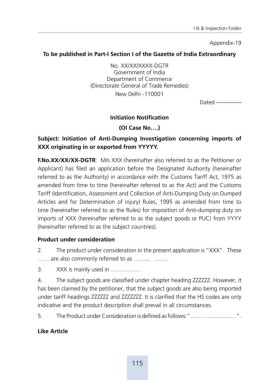

Page 138 - MANUAL OF SOP

P. 138

I N & Inspection Folder

Appendix-19

To be published in Part-I Section I of the Gazette of India Extraordinary

No. XX/XX/XXXX-DGTR

Government of India

Department of Commerce

(Directorate General of Trade Remedies)

New Delhi -110001

Dated -------------

Initiation Notification

(OI Case No….)

Subject: Initiation of Anti-Dumping Investigation concerning imports of

XXX originating in or exported from YYYYY.

F.No.XX/XX/XX-DGTR: M/s XXX (hereinafter also referred to as the Petitioner or

Applicant) has filed an application before the Designated Authority (hereinafter

referred to as the Authority) in accordance with the Customs Tariff Act, 1975 as

amended from time to time (hereinafter referred to as the Act) and the Customs

Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped

Articles and for Determination of injury) Rules, 1995 as amended from time to

time (hereinafter referred to as the Rules) for imposition of Anti-dumping duty on

imports of XXX (hereinafter referred to as the subject goods or PUC) from YYYY

(hereinafter referred to as the subject countries).

Product under consideration

2. The product under consideration in the present application is “XXX”. These

…… are also commonly referred to as ……... …….

3. XXX is mainly used in …….………

4. The subject goods are classified under chapter heading ZZZZZZ. However, it

has been claimed by the petitioner, that the subject goods are also being imported

under tariff headings ZZZZZZ and ZZZZZZZ. It is clarified that the HS codes are only

indicative and the product description shall prevail in all circumstances.

5. The Product under Consideration is defined as follows:“……………………”.

Like Article

115