Page 21 - Investing in Praetura Group - Christopher Carter

P. 21

21

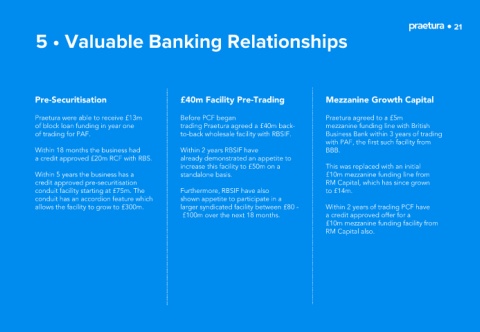

5 • Valuable Banking Relationships

Pre-Securitisation £40m Facility Pre-Trading Mezzanine Growth Capital

Praetura were able to receive £13m Before PCF began Praetura agreed to a £5m

of block loan funding in year one trading Praetura agreed a £40m back- mezzanine funding line with British

of trading for PAF. to-back wholesale facility with RBSIF. Business Bank within 3 years of trading

with PAF, the first such facility from

Within 18 months the business had Within 2 years RBSIF have BBB.

a credit approved £20m RCF with RBS. already demonstrated an appetite to

increase this facility to £50m on a This was replaced with an initial

Within 5 years the business has a standalone basis. £10m mezzanine funding line from

credit approved pre-securitisation RM Capital, which has since grown

conduit facility starting at £75m. The Furthermore, RBSIF have also to £14m.

conduit has an accordion feature which shown appetite to participate in a

allows the facility to grow to £300m. larger syndicated facility between £80 - Within 2 years of trading PCF have

£100m over the next 18 months. a credit approved offer for a

£10m mezzanine funding facility from

RM Capital also.