Page 19 - Praetura EIS 2019 Information Memorandum

P. 19

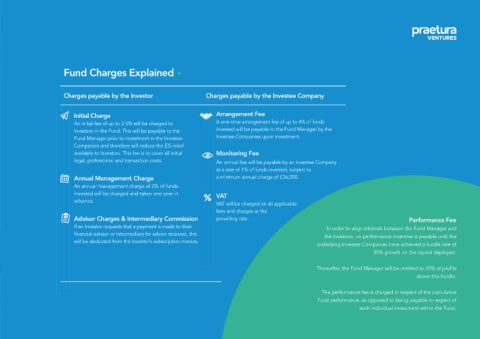

Fund Charges Explained

Charges payable by the Investor Charges payable by the Investee Company

• Initial Charge Arrangement Fee

An initial fee of up to 2.5% will be charged to A one-time arrangement fee of up to 4% of funds

Investors in the Fund. This will be payable to the invested will be payable to the Fund Manager by the

Fund Manager prior to investment in the Investee Investee Companies upon investment.

Companies and therefore will reduce the EIS relief

available to Investors. This fee is to cover all initial • Monitoring Fee

legal, professional and transaction costs. An annual fee will be payable by an Investee Company

at a rate of 1% of funds invested, subject to

• Annual Management Charge a minimum annual charge of £36,000.

An annual management charge of 2% of funds

invested will be charged and taken one year in VAT

advance.

VAT will be charged on all applicable

fees and charges at the

• Advisor Charges & Intermediary Commission prevailing rate. Performance Fee

If an Investor requests that a payment is made to their In order to align interests between the Fund Manager and

financial advisor or intermediary for advice received, this the Investors, no performance incentive is payable until the

will be deducted from the Investor’s subscription monies. underlying Investee Companies have achieved a hurdle rate of

30% growth on the capital deployed.

Thereafter, the Fund Manager will be entitled to 20% of profits

above this hurdle.

The performance fee is charged in respect of the cumulative

Fund performance, as opposed to being payable in respect of

each individual investment within the Fund.