Page 9 - Introduction to the Praetura Group

P. 9

9

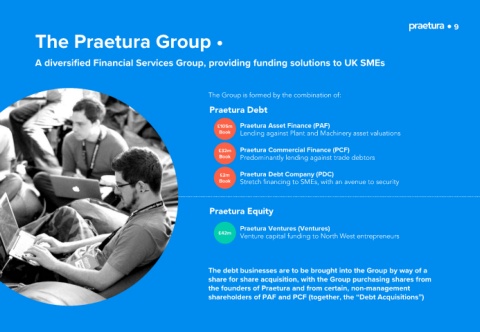

The Praetura Group •

A diversified Financial Services Group, providing funding solutions to UK SMEs

The Group is formed by the combination of:

Praetura Debt

£105m Praetura Asset Finance (PAF)

Book Lending against Plant and Machinery asset valuations

£32m Praetura Commercial Finance (PCF)

Book Predominantly lending against trade debtors

£2m Praetura Debt Company (PDC)

Book Stretch financing to SMEs, with an avenue to security

Praetura Equity

Praetura Ventures (Ventures)

£42m

Venture capital funding to North West entrepreneurs

The debt businesses are to be brought into the Group by way of a

share for share acquisition, with the Group purchasing shares from

the founders of Praetura and from certain, non-management

shareholders of PAF and PCF (together, the “Debt Acquisitions”)