Page 77 - IM - Praetura Ventures 2019 EIS Fund

P. 77

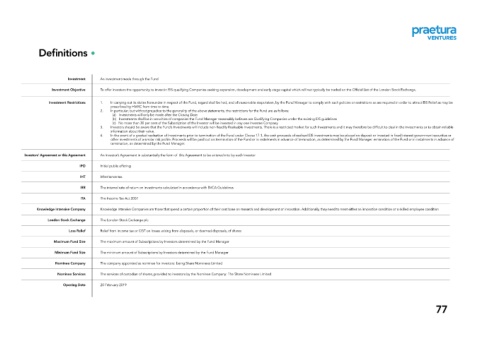

Definitions

Investment An investment made through the Fund

Investment Objective To offer investors the opportunity to invest in EIS-qualifying Companies seeking expansion, development and early stage capital which will not typically be traded on the Official List of the London Stock Exchange.

Investment Restrictions 1. In carrying out its duties hereunder in respect of the Fund, regard shall be had, and all reasonable steps taken, by the Fund Manager to comply with such policies or restrictions as are required in order to attract EIS Relief as may be

prescribed by HMRC from time to time.

2. In particular, but without prejudice to the generality of the above statements, the restrictions for the Fund are as follows:

(a) Investments will only be made after the Closing Date

(b) Investments shall be in securities of companies the Fund Manager reasonably believes are Qualifying Companies under the existing EIS guidelines

(c) No more than 30 per cent of the Subscription of the Investor will be invested in any one Investee Company

3. Investors should be aware that the Fund’s Investments will include non-Readily Realisable Investments. There is a restricted market for such Investments and it may therefore be difficult to deal in the Investments or to obtain reliable

information about their value.

4. In the event of a gradual realisation of Investments prior to termination of the Fund under Clause 17.1, the cash proceeds of realised EIS investments may be placed on deposit or invested in fixed interest government securities or

other investments of a similar risk profile. Proceeds will be paid out on termination of the Fund or in instalments in advance of termination, as determined by the Fund Manager. ermination of the Fund or in instalments in advance of

termination, as determined by the Fund Manager.

Investors’ Agreement or this Agreement An Investor’s Agreement in substantially the form of this Agreement to be entered into by each Investor

IPO Initial public offering

IHT Inheritance tax

IRR The internal rate of return on investments calculated in accordance with BVCA Guidelines

ITA The Income Tax Act 2007

Knowledge Intensive Company Knowledge Intensive Companies are those that spend a certain proportion of their cost base on research and development or innovation. Additionally, they need to meet either an innovation condition or a skilled employee condition

London Stock Exchange The London Stock Exchange plc

Loss Relief Relief from income tax or CGT on losses arising from disposals, or deemed disposals, of shares

Maximum Fund Size The maximum amount of Subscriptions by Investors determined by the Fund Manager

Minimum Fund Size The minimum amount of Subscriptions by Investors determined by the Fund Manager

Nominee Company The company appointed as nominee for investors: being Share Nominees Limited

Nominee Services The services of custodian of shares, provided to investors by the Nominee Company: The Share Nominees Limited

Opening Date 20 February 2019

77