Page 129 - Capricorn IAR 2020

P. 129

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL

FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

1.

1.3

1.3.1

1.3.1 (a)

(i)

BASIS OF PRESENTATION (continued)

Standards and interpretations issued (continued)

Standards and interpretations issued affecting amounts reported and disclosures in the current year (continued)

Changes in accounting policy

The Group has adopted IFRS 16 – ‘Leases’ from 1 July 2019 using the modified retrospective approach. Under this approach the Group has not restated comparatives for the 2019 reporting period, as permitted under the specific transition provisions in IFRS 16. The adjustments arising from the new leasing rules are therefore recognised in the opening statement of financial position on 1 July 2019. Comparative information continues to be reported under IAS17 and IFRIC 4.

On adoption of IFRS 16, as a lessee, the Group recognised lease liabilities in relation to leases which had previously been classified as ‘operating leases’ under the principles of IAS 17 Leases. These liabilities were measured at the present value of the remaining lease payments, discounted using the Group’s incremental borrowing rate as at 1 July 2019. The weighted average lessee’s incremental borrowing rate applied to the lease liabilities on 1 July 2019 was 7.64%.

Practical expedients applied

In applying IFRS 16 for the first time, the Group has used the following practical expedients permitted by the standard:

• Applying a single discount rate to a portfolio of leases with reasonably similar characteristics

• Relying on previous assessments on whether leases are onerous as an alternative to performing an impairment review – there

were no onerous contracts as at 1 July 2019

• Excluding initial direct costs for the measurement of the right-of-use asset at the date of initial application

• Using hindsight in determining the lease term where the contract contains options to extend or terminate the lease

The Group has also elected not to reassess whether a contract is, or contains a lease at the date of initial application. Instead, for contracts entered into before the transition date, the Group relied on its assessment made applying IAS 17 and Interpretation 4 – ‘Determining whether an Arrangement contains a Lease’.

The Group decided to apply recognition exemptions to all short-term leases and leases of low-value assets.

There were no leases classified as finance leases under IAS 17 at the date of initial application, nor did the Group act as a lessor at that date.

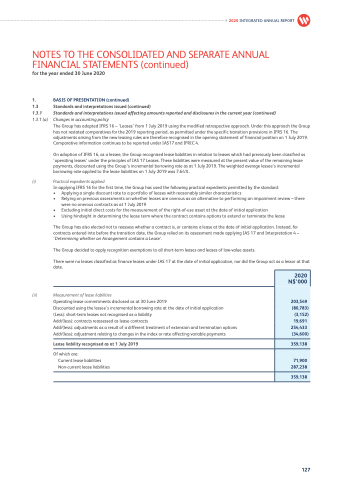

Measurement of lease liabilities

Operating lease commitments disclosed as at 30 June 2019

Discounted using the lessee's incremental borrowing rate at the date of initial application

(Less): short-term leases not recognised as a liability

Add/(less): contracts reassessed as lease contracts

Add/(less): adjustments as a result of a different treatment of extension and termination options Add/(less): adjustment relating to changes in the index or rate affecting variable payments

Lease liability recognised as at 1 July 2019

Of which are:

Current lease liabilities Non-current lease liabilities

2020 N$’000

203,549

(80,783)

(3,152)

19,691

254,433

(34,600)

359,138

71,900

287,238

359,138

(ii)

127