Page 130 - Capricorn IAR 2020

P. 130

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL

FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

1.

1.3

1.3.1

1.3.1 (a)

(iii)

(iv)

1.3.1 (b)

BASIS OF PRESENTATION (continued)

Standards and interpretations issued (continued)

Standards and interpretations issued affecting amounts reported and disclosures in the current year (continued)

Changes in accounting policy

Measurement of right-of-use assets

Right-of-use assets were measured at the amount equal to the lease liability, adjusted by the amount of any

prepaid or accrued lease payments relating to the lease recognised in the statement of financial position as at 30 June 2019.

Adjustments recognised in the statement of financial position on 1 July 2019:

• •

*

Property and equipment* – increased by N$359 million Other liabilities* – increased by N$359 million

Right-of-use assets and lease liabilities have been disclosed as part of property and equipment and other liabilities respectively on the statement of financial position.

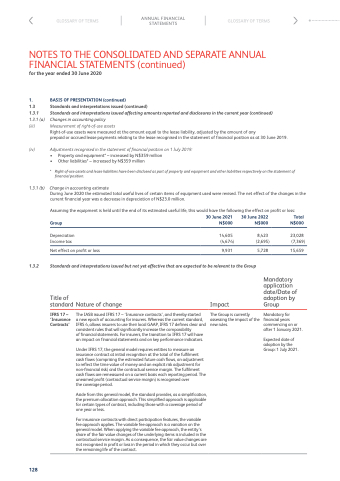

Change in accounting estimate

During June 2020 the estimated total useful lives of certain items of equipment used were revised. The net effect of the changes in the current financial year was a decrease in depreciation of N$23.0 million.

Assuming the equipment is held until the end of its estimated useful life, this would have the following the effect on profit or loss:

Group

Depreciation Income tax

Net effect on profit or loss

30 June 2021 N$000

14,605 (4,674)

9,931

30 June 2022 N$000

8,423 (2,695)

5,728

Total N$000

23,028 (7,369)

15,659

1.3.2

Standards and interpretations issued but not yet effective that are expected to be relevant to the Group

Title of

standard Nature of change

Impact

The Group is currently assessing the impact of the new rules.

Mandatory application date/Date of adoption by Group

Mandatory for financial years commencing on or after 1 January 2021.

Expected date of adoption by the Group: 1 July 2021.

IFRS 17 – ‘Insurance Contracts’

The IASB issued IFRS 17 – ‘Insurance contracts’, and thereby started

a new epoch of accounting for insurers. Whereas the current standard, IFRS 4, allows insurers to use their local GAAP, IFRS 17 defines clear and consistent rules that will significantly increase the comparability

of financial statements. For insurers, the transition to IFRS 17 will have an impact on financial statements and on key performance indicators.

Under IFRS 17, the general model requires entities to measure an insurance contract at initial recognition at the total of the fulfilment cash flows (comprising the estimated future cash flows, an adjustment to reflect the time value of money and an explicit risk adjustment for non-financial risk) and the contractual service margin. The fulfilment cash flows are remeasured on a current basis each reporting period. The unearned profit (contractual service margin) is recognised over

the coverage period.

Aside from this general model, the standard provides, as a simplification, the premium allocation approach. This simplified approach is applicable for certain types of contract, including those with a coverage period of one year or less.

For insurance contracts with direct participation features, the variable fee approach applies. The variable fee approach is a variation on the general model. When applying the variable fee approach, the entity’s share of the fair value changes of the underlying items is included in the contractual service margin. As a consequence, the fair value changes are not recognised in profit or loss in the period in which they occur but over the remaining life of the contract.

128