Page 159 - Capricorn IAR 2020

P. 159

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.2 Expected credit loss measurement (continued)

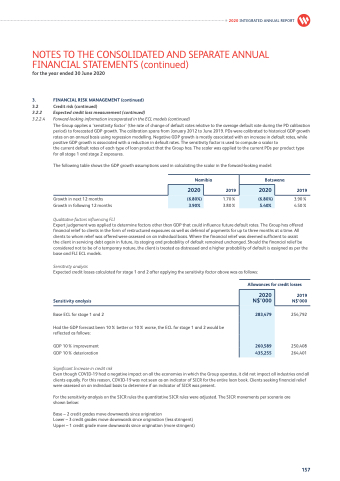

3.2.2.4 Forward-looking information incorporated in the ECL models (continued)

The Group applies a ‘sensitivity factor’ (the rate of change of default rates relative to the average default rate during the PD calibration period) to forecasted GDP growth. The calibration spans from January 2012 to June 2019. PDs were calibrated to historical GDP growth rates on an annual basis using regression modelling. Negative GDP growth is mostly associated with an increase in default rates, while positive GDP growth is associated with a reduction in default rates. The sensitivity factor is used to compute a scalar to

the current default rates of each type of loan product that the Group has. The scaler was applied to the current PDs per product type for all stage 1 and stage 2 exposures.

The following table shows the GDP growth assumptions used in calculating the scalar in the forward-looking model:

Namibia

Botswana

Growth in next 12 months Growth in following 12 months

Qualitative factors influencing FLI

2019

1.70% 3.80%

2019

3.90% 4.50%

Expert judgement was applied to determine factors other than GDP that could influence future default rates. The Group has offered financial relief to clients in the form of restructured exposures as well as deferral of payments for up to three months at a time. All clients to whom relief was offered were assessed on an individual basis. Where the financial relief was deemed sufficient to assist

the client in servicing debt again in future, its staging and probability of default remained unchanged. Should the financial relief be considered not to be of a temporary nature, the client is treated as distressed and a higher probability of default is assigned as per the base and FLI ECL models.

Sensitivity analysis

Expected credit losses calculated for stage 1 and 2 after applying the sensitivity factor above was as follows:

2020

(6.80%)

3.90%

2020

(6.80%)

5.40%

2020 N$’000

283,479

260,589

435,255

Sensitivity analysis

Base ECL for stage 1 and 2

Had the GDP forecast been 10% better or 10% worse, the ECL for stage 1 and 2 would be reflected as follows:

GDP 10% improvement GDP 10% deterioration

Significant Increase in credit risk

Allowances for credit losses

2019 N$’000

254,792

250,408 264,401

Even though COVID-19 had a negative impact on all the economies in which the Group operates, it did not impact all industries and all clients equally. For this reason, COVID-19 was not seen as an indicator of SICR for the entire loan book. Clients seeking financial relief were assessed on an individual basis to determine if an indicator of SICR was present.

For the sensitivity analysis on the SICR rules the quantitative SICR rules were adjusted. The SICR movements per scenario are shown below:

Base – 2 credit grades move downwards since origination

Lower – 3 credit grades move downwards since origination (less stringent) Upper – 1 credit grade move downwards since origination (more stringent)

157