Page 161 - Capricorn IAR 2020

P. 161

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

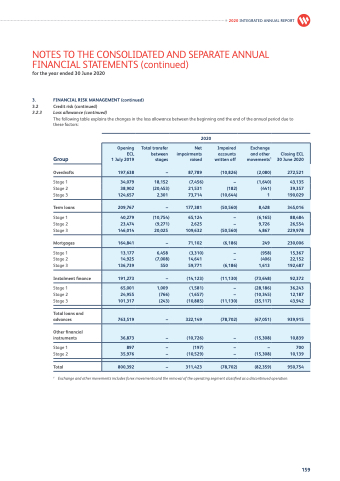

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.3 Loss allowance (continued)

The following table explains the changes in the loss allowance between the beginning and the end of the annual period due to these factors:

Group

Overdrafts

Stage 1 Stage 2 Stage 3

Term loans

Stage 1 Stage 2 Stage 3

Mortgages

Stage 1 Stage 2 Stage 3

Instalment finance

Stage 1 Stage 2 Stage 3

Total loans and advances

Other financial instruments

Stage 1 Stage 2

Total

Opening ECL 1 July 2019

197,638

34,079

38,902 124,657

209,767

40,279

23,474 146,014

164,841

13,177

14,925 136,739

191,273

65,001

24,955 101,317

763,519

36,873

897 35,976

800,392

Total transfer between stages

–

18,152 (20,453)

2,301

–

(10,754) (9,271)

20,025

–

6,458 (7,008)

550

–

1,009 (766) (243)

–

–

– –

–

2020

Net impairments raised

87,789

(7,456) 21,531 73,714

177,381

65,124 2,625 109,632

71,102

(3,310) 14,641 59,771

(14,123)

(1,581)

(1,657) (10,885)

322,149

(10,726)

(197) (10,529)

311,423

Impaired accounts written off

(10,826)

– (182) (10,644)

(50,560)

–

– (50,560)

(6,186)

–

– (6,186)

(11,130)

–

– (11,130)

(78,702)

–

– –

(78,702)

Exchange

and other movements1

(2,080)

(1,640) (441)

1

8,428

(6,165) 9,726 4,867

249

(958)

(406) 1,613

(73,648)

(28,186) (10,345) (35,117)

(67,051)

(15,308)

– (15,308)

(82,359)

Closing ECL 30 June 2020

272,521

43,135

39,357 190,029

345,016

88,484

26,554 229,978

230,006

15,367

22,152 192,487

92,372

36,243 12,187 43,942

939,915

10,839

700 10,139

950,754

1 Exchange and other movements includes forex movements and the removal of the operating segment classified as a discontinued operation.

159