Page 196 - Capricorn IAR 2020

P. 196

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

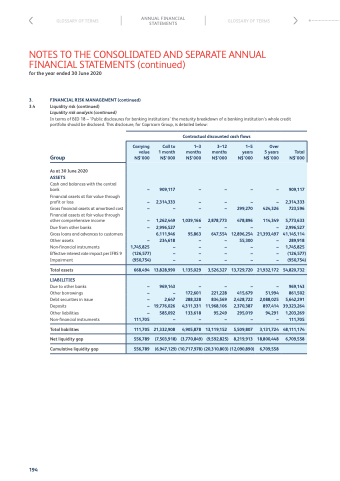

3. FINANCIAL RISK MANAGEMENT (continued)

3.4 Liquidity risk (continued)

Liquidity risk analysis (continued)

In terms of BID 18 – ‘Public disclosures for banking institutions’ the maturity breakdown of a banking institution’s whole credit portfolio should be disclosed. This disclosure, for Capricorn Group, is detailed below:

Contractual discounted cash flows

Carrying value N$’000

Call to 1 month N$’000

1–3 months N$’000

3–12 months N$’000

1–5 years N$’000

Over 5 years N$’000

Total N$’000

–

909,117

–

–

–

–

909,117

–

2,314,333

–

–

–

–

2,314,333

–

–

–

–

299,270

424,326

723,596

–

1,262,449

1,039,166

2,878,773

478,896

114,349

5,773,633

–

2,996,527

–

–

–

–

2,996,527

6,111,946

95,863

647,554

12,896,254

21,393,497

41,145,114

–

234,618

–

–

55,300

–

289,918

1,745,825

–

–

–

–

–

1,745,825

(126,577)

–

–

–

–

–

(126,577)

(950,754)

–

–

–

–

–

(950,754)

668,494

13,828,990

1,135,029

3,526,327

13,729,720

21,932,172

54,820,732

–

969,143

–

–

–

–

969,143

–

–

172,601

221,228

415,679

51,994

861,502

–

2,647

288,328

834,569

2,428,722

2,088,025

5,642,291

–

19,776,026

4,311,331

11,968,106

2,370,387

897,414

39,323,264

–

585,092

133,618

95,249

295,019

94,291

1,203,269

111,705

–

–

–

–

–

111,705

111,705

21,332,908

4,905,878

13,119,152

5,509,807

3,131,724

48,111,174

556,789

(7,503,918)

(3,770,849)

(9,592,825)

8,219,913

18,800,448

6,709,558

556,789

(6,947,129)

(10,717,978)

(20,310,803)

(12,090,890)

6,709,558

Group

As at 30 June 2020

ASSETS

Cash and balances with the central bank

Financial assets at fair value through profit or loss

Gross financial assets at amortised cost Financial assets at fair value through other comprehensive income

Due from other banks

Gross loans and advances to customers Other assets

Non-financial instruments

Effective interest rate impact per IFRS 9 Impairment

Total assets

LIABILITIES

Due to other banks Other borrowings Debt securities in issue Deposits

Other liabilities Non-financial instruments

Total liabilities

Net liquidity gap Cumulative liquidity gap

194