Page 199 - Capricorn IAR 2020

P. 199

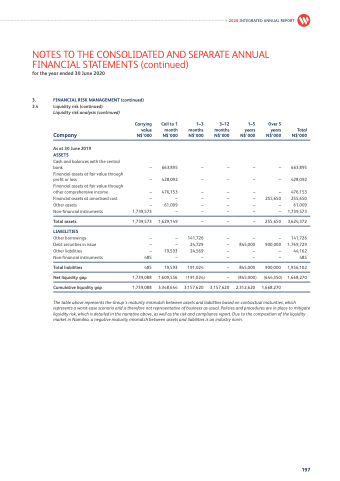

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.4 Liquidity risk (continued)

Liquidity risk analysis (continued)

Carrying value Company N$’000

Call to 1 month N$’000

663,895 428,092 476,153

– 61,009 –

1,629,149

–

– 19,593 –

19,593

1,609,556

3,348,644

1–3 3–12 months months N$’000 N$’000

– –

– –

– –

– –

– –

– –

– –

141,726 – 24,729 – 24,569 –

– –

191,024 –

(191,024) –

3,157,620 3,157,620

1–5 Over 5 years years N$’000 N$’000

– – – –

– – – 255,650 – – – –

– 255,650

– – 845,000 900,000 – – – –

845,000 900,000

(845,000) (644,350)

2,312,620 1,668,270

Total N$’000

663,895 428,092

476,153 255,650 61,009 1,739,573

3,624,372

141,726 1,769,729 44,162 485

1,956,102

1,668,270

2020 INTEGRATED ANNUAL REPORT

As at 30 June 2019

ASSETS

Cash and balances with the central bank

Financial assets at fair value through profit or loss

Financial assets at fair value through other comprehensive income Financial assets at amortised cost Other assets

Non-financial instruments

Total assets

LIABILITIES

Other borrowings

Debt securities in issue Other liabilities Non-financial instruments

Total liabilities

Net liquidity gap

Cumulative liquidity gap

– –

– – –

1,739,573

1,739,573

– – –

485

485

1,739,088

1,739,088

The table above represents the Group’s maturity mismatch between assets and liabilities based on contractual maturities, which represents a worst-case scenario and is therefore not representative of business as usual. Policies and procedures are in place to mitigate liquidity risk, which is detailed in the narrative above, as well as the risk and compliance report. Due to the composition of the liquidity market in Namibia, a negative maturity mismatch between assets and liabilities is an industry norm.

197