Page 203 - Capricorn IAR 2020

P. 203

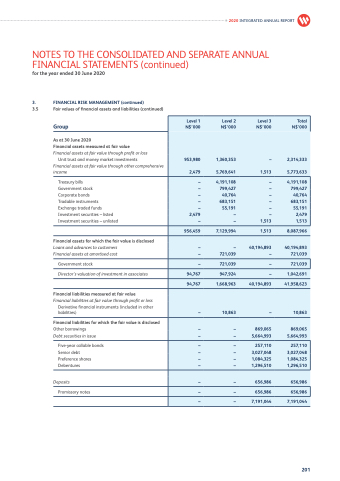

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.5 Fair values of financial assets and liabilities (continued)

Level 1 Group N$’000

As at 30 June 2020

Financial assets measured at fair value Financial assets at fair value through profit or loss

Unit trust and money market investments 953,980

Financial assets at fair value through other comprehensive

income 2,479

Level 2 N$’000

1,360,353

5,769,641

4,191,108 799,427 40,764 683,151 55,191 – –

7,129,994

– 721,039

721,039

947,924

1,668,963

10,863

– –

– – – –

– –

–

Level 3 N$’000

–

1,513

– – – – – –

1,513

1,513

40,194,893 –

–

–

40,194,893

–

869,065 5,664,993

257,110 3,027,048 1,084,325 1,296,510

656,986 656,986

7,191,044

Total N$’000

2,314,333

5,773,633

4,191,108 799,427 40,764 683,151 55,191 2,479 1,513

8,087,966

40,194,893 721,039

721,039

1,042,691

41,958,623

10,863

869,065 5,664,993

257,110 3,027,048 1,084,325 1,296,510

656,986 656,986

7,191,044

2020 INTEGRATED ANNUAL REPORT

Treasury bills

Government stock

Corporate bonds

Tradable instruments Exchange traded funds Investment securities – listed Investment securities – unlisted

Financial assets for which the fair value is disclosed

Loans and advances to customers Financial assets at amortised cost

Government stock

Director’s valuation of investment in associates

Financial liabilities measured at fair value

Financial liabilities at fair value through profit or loss

Derivative financial instruments (included in other liabilities)

Financial liabilities for which the fair value is disclosed

Other borrowings

Debt securities in issue

Five-year callable bonds Senior debt

Preference shares Debentures

Deposits

Promissory notes

– – – – –

2,479 –

956,459

– –

–

94,767

94,767

–

– –

– – – –

– –

–

201