Page 204 - Capricorn IAR 2020

P. 204

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

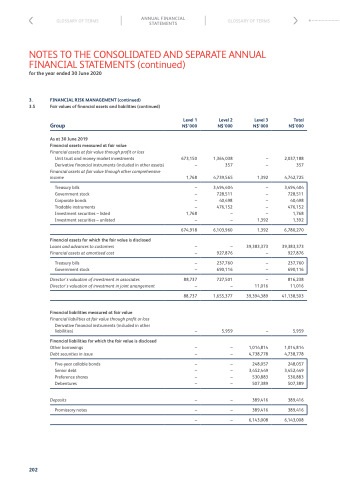

3. FINANCIAL RISK MANAGEMENT (continued)

3.5 Fair values of financial assets and liabilities (continued)

Level 1 Group N$’000

Level 2 N$’000

1,364,038 357

4,739,565

3,494,404 728,511 40,498 476,152 – –

6,103,960

– 927,876

237,760 690,116

727,501 –

1,655,377

5,959

– –

– – – –

–

–

–

Level 3 N$’000

– –

1,392

– – – – –

1,392

1,392

39,383,373 –

– –

– 11,016

39,394,389

–

1,014,814 4,738,778

248,057 3,452,449 530,883 507,389

389,416

389,416

6,143,008

Total N$’000

2,037,188 357

4,742,725

3,494,404 728,511 40,498 476,152 1,768 1,392

6,780,270

39,383,373 927,876

237,760 690,116

816,238 11,016

41,138,503

5,959

1,014,814 4,738,778

248,057 3,452,449 530,883 507,389

389,416

389,416

6,143,008

As at 30 June 2019

Financial assets measured at fair value Financial assets at fair value through profit or loss

Unit trust and money market investments

Derivative financial instruments (included in other assets)

673,150 –

Financial assets at fair value through other comprehensive

income 1,768

Treasury bills

Government stock

Corporate bonds

Tradable instruments Investment securities – listed Investment securities – unlisted

Financial assets for which the fair value is disclosed

Loans and advances to customers Financial assets at amortised cost

Treasury bills Government stock

Director’s valuation of investment in associates Director’s valuation of investment in joint arrangement

Financial liabilities measured at fair value

Financial liabilities at fair value through profit or loss

Derivative financial instruments (included in other liabilities)

Financial liabilities for which the fair value is disclosed

Other borrowings

Debt securities in issue

Five-year callable bonds Senior debt

Preference shares Debentures

Deposits

Promissory notes

– – – –

1,768 –

674,918

– –

– –

88,737 –

88,737

–

– –

– – – –

–

–

–

202