Page 221 - Capricorn IAR 2020

P. 221

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

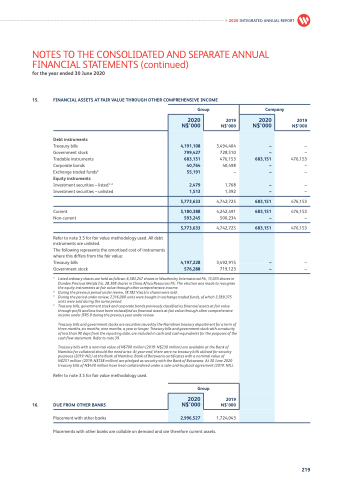

15. FINANCIAL ASSETS AT FAIR VALUE THROUGH OTHER COMPREHENSIVE INCOME

2020 INTEGRATED ANNUAL REPORT

Group

Company

2019 N$’000

–

– 476,153 – –

– –

476,153

476,153 –

476,153

– –

2020 N$’000

683,151

40,764

2020 N$’000

4,191,108

3,494,404 728,510 476,153

40,498 –

1,768 1,392

683,151

–

799,427

–

–

55,191

–

2,479

–

1,513

–

5,773,633

4,742,725

683,151

5,180,388

4,242,491 500,234

683,151

593,245

–

5,773,633

4,742,725

3,492,915 719,123

683,151

4,197,228

–

576,288

–

2020 N$’000

2,996,527

1,724,043

2019 N$’000

Debt instruments

Treasury bills

Government stock

Tradable instruments Corporate bonds

Exchange traded funds3

Equity instruments Investment securities – listed1, 2 Investment securities – unlisted

Current Non-current

Refer to note 3.5 for fair value methodology used. All debt instruments are unlisted.

The following represents the amortised cost of instruments where this differs from the fair value:

Treasury bills Government stock

1 Listed ordinary shares are held as follows: 6,583,247 shares in Weatherley International Plc, 13,035 shares in Dundee Precious Metals Inc, 28,308 shares in China Africa Resources Plc. The election was made to recognise the equity instruments at fair value through other comprehensive income.

2 During the previous period under review, 18,182 Visa Inc shares were sold.

3 During the period under review, 7,316,000 units were bought in exchange traded funds, of which 3,589,375

units were sold during the same period.

* Treasury bills, government stock and corporate bonds previously classified as financial assets at fair value

through profit and loss have been reclassified as financial assets at fair value through other comprehensive income under IFRS 9 during the previous year under review.

Treasury bills and government stocks are securities issued by the Namibian treasury department for a term of three months, six months, nine months, a year or longer. Treasury bills and government stock with a maturity of less than 90 days from the reporting date, are included in cash and cash equivalents for the purposes of the cash flow statement. Refer to note 39.

Treasury bills with a nominal value of N$700 million (2019: N$230 million) are available at the Bank of Namibia for collateral should the need arise. At year-end, there were no treasury bills utilised for security purposes (2019: NIL) at the Bank of Namibia. Bank of Botswana certificates with a nominal value of N$251 million (2019: N$138 million) are pledged as security with the Bank of Botswana. At 30 June 2020 treasury bills of N$430 million have been collateralised under a sale-and-buyback agreement (2019: NIL).

Refer to note 3.5 for fair value methodology used.

16. DUE FROM OTHER BANKS

Group

2019 N$’000

Placement with other banks

Placements with other banks are callable on demand and are therefore current assets.

219