Page 219 - Capricorn IAR 2020

P. 219

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

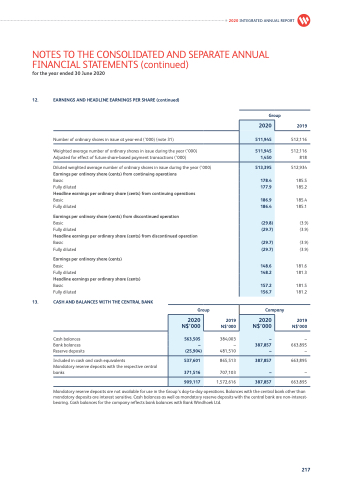

12. EARNINGS AND HEADLINE EARNINGS PER SHARE (continued)

Number of ordinary shares in issue at year-end (’000) (note 31)

Weighted average number of ordinary shares in issue during the year (’000) Adjusted for effect of future share-based payment transactions (’000)

Diluted weighted average number of ordinary shares in issue during the year (’000)

Earnings per ordinary share (cents) from continuing operations

Basic

Fully diluted

Headline earnings per ordinary share (cents) from continuing operations Basic

Fully diluted

Earnings per ordinary share (cents) from discontinued operation

Basic

Fully diluted

Headline earnings per ordinary share (cents) from discontinued operation Basic

Fully diluted

Group

2019

2020 INTEGRATED ANNUAL REPORT

2020

511,945

511,945

1,450

513,395

178.4

177.9

186.9

186.4

(29.8)

(29.7)

(29.7)

(29.7)

148.6

148.2

157.2

156.7

Earnings per ordinary share (cents)

Basic

Fully diluted

Headline earnings per ordinary share (cents) Basic

Fully diluted

13. CASH AND BALANCES WITH THE CENTRAL BANK

Cash balances Bank balances Reserve deposits

Included in cash and cash equivalents

Mandatory reserve deposits with the respective central banks

Group

Company

512,116

512,116 818

512,934

185.5 185.2

185.4 185.1

(3.9) (3.9)

(3.9) (3.9)

181.6 181.3

181.5 181.2

2019 N$’000

– 663,895 –

663,895

– 663,895

2020 N$’000

–

2020 N$’000

563,505

384,003 – 481,510

387,857

–

(25,904)

–

537,601

371,516

865,513 707,103

387,857

–

909,117

1,572,616

387,857

2019 N$’000

Mandatory reserve deposits are not available for use in the Group’s day-to-day operations. Balances with the central bank other than mandatory deposits are interest sensitive. Cash balances as well as mandatory reserve deposits with the central bank are non-interest- bearing. Cash balances for the company reflects bank balances with Bank Windhoek Ltd.

217