Page 217 - Capricorn IAR 2020

P. 217

for the year ended 30 June 2020

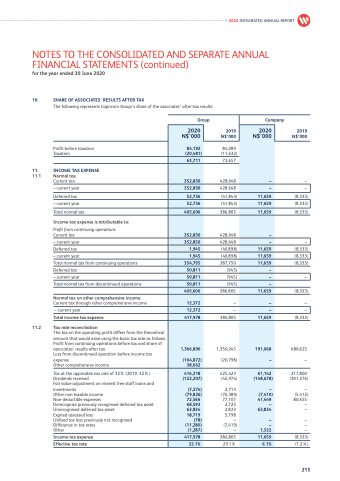

10. SHARE OF ASSOCIATES’ RESULTS AFTER TAX

The following represents Capricorn Group’s share of the associates’ after-tax results:

428,648

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

Group

2020 N$’000

84,192 (20,481)

63,711

352,850

352,850

52,756

52,756

405,606

352,850

352,850

1,945

1,945

354,795

50,811

50,811

50,811

405,606

12,372

12,372

417,978

Company

Profit before taxation Taxation

11. INCOME TAX EXPENSE

11.1 Normal tax

Current tax

– current year

Deferred tax

– current year

Total normal tax

Income tax expense is attributable to:

Profit from continuing operations

Current tax

– current year

Deferred tax

– current year

Total normal tax from continuing operations

Deferred tax

– current year

Total normal tax from discontinued operations

Normal tax on other comprehensive income

Current tax through other comprehensive income

– current year

Total income tax expense

11.2 Tax rate reconciliation

The tax on the operating profit differs from the theoretical amount that would arise using the basic tax rate as follows: Profit from continuing operations before tax and share of associates’ results after tax

2019 N$’000

2019 N$’000

–

(8,333)

(8,333)

(8,333) (8,333)

(8,333) –

(8,333)

84,289 (11,632)

2020 N$’000

72,657

–

428,648

(41,843)

–

–

(41,843)

11,659

11,659

(8,333)

386,805

11,659

428,648

–

428,648

(40,898)

–

–

11,659

(40,898)

11,659

(8,333)

387,750

11,659

(945)

–

(945)

–

–

(945)

386,805

–

11,659

–

–

386,805

1,350,245 (20,798)

–

11,659

–

–

1,366,890 expense (104,872)

680,625 –

217,800 (301,376)

– (5,412)

80,655 – –

– – –

(8,333) (1.2%)

Loss from discontinued operation before income tax Other comprehensive income

Tax at the applicable tax rate of 32% (2019: 32%)

Dividends received

Fair value adjustment on interest free staff loans and

investments (7,274)

38,662

191,068

Other non-taxable income

Non-deductible expenses

Derecognise previously recognised deferred tax asset

Unrecognised deferred tax asset

Expired assessed loss

Utilised tax loss previously not recognised

Difference in tax rates

Other (1,287)

Income tax expense 417,978

Effective tax rate 32.1%

416,218 (122,207)

(79,826) 72,566 68,593 63,834 18,719

(78) (11,280)

425,423 (45,974)

2,713 (76,389)

77,107 2,723 2,823 5,798

– (7,419)

–

29.1%

61,142

(148,678)

(7,410)

41,449

63,834

1,322

11,659

–

–

–

–

–

386,805

6.1%

215