Page 225 - Capricorn IAR 2020

P. 225

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

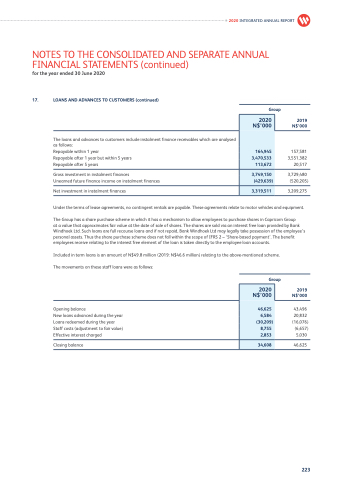

17. LOANS AND ADVANCES TO CUSTOMERS (continued)

The loans and advances to customers include instalment finance receivables which are analysed as follows:

Repayable within 1 year

Repayable after 1 year but within 5 years

Repayable after 5 years

Gross investment in instalment finances

Unearned future finance income on instalment finances

Net investment in instalment finances

Group

2020 N$’000

164,945

3,470,533

113,672

3,749,150

(429,639)

3,319,511

2019 N$’000

157,581 3,551,382 20,517

3,729,480 (520,205)

3,209,275

Under the terms of lease agreements, no contingent rentals are payable. These agreements relate to motor vehicles and equipment.

The Group has a share purchase scheme in which it has a mechanism to allow employees to purchase shares in Capricorn Group

at a value that approximates fair value at the date of sale of shares. The shares are sold via an interest free loan provided by Bank Windhoek Ltd. Such loans are full recourse loans and if not repaid, Bank Windhoek Ltd may legally take possession of the employee’s personal assets. Thus the share purchase scheme does not fall within the scope of IFRS 2 – ‘Share-based payment’. The benefit employees receive relating to the interest free element of the loan is taken directly to the employee loan accounts.

Included in term loans is an amount of N$49.8 million (2019: N$46.6 million) relating to the above-mentioned scheme. The movements on these staff loans were as follows:

Group

2020 N$’000

46,625

6,584

(30,209)

8,755

2,853

34,608

Opening balance

New loans advanced during the year Loans redeemed during the year Staff costs (adjustment to fair value) Effective interest charged

Closing balance

2019 N$’000

43,496

20,832 (16,076) (6,657)

5,030 46,625

223