Page 226 - Capricorn IAR 2020

P. 226

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

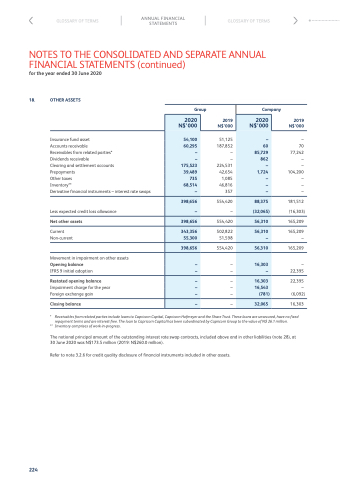

18. OTHER ASSETS

Insurance fund asset

Accounts receivable

Receivables from related parties*

Dividends receivable

Clearing and settlement accounts

Prepayments

Other taxes

Inventory**

Derivative financial instruments – interest rate swaps

Less expected credit loss allowance

Net other assets

Current Non-current

Movement in impairment on other assets

Opening balance

IFRS 9 initial adoption

Restated opening balance

Impairment charge for the year Foreign exchange gain

Closing balance

Group

Company

2020 N$’000

175,523

2020 N$’000

54,100

51,125 187,852 – – 224,531 42,654 1,085 46,816 357

85,729

60

–

60,295

–

–

862

–

39,489

1,724

735

–

68,514

–

–

–

398,656

554,420 –

88,375

–

(32,065)

398,656

554,420

56,310

343,356

502,822 51,598

56,310

55,300

–

398,656

554,420

56,310

–

– –

16,303

–

–

–

–

– – –

16,303

16,543

–

(781)

–

–

32,065

2019 N$’000

2019 N$’000

– 70 77,242 – – 104,200 – – –

181,512 (16,303)

165,209

165,209 –

165,209

– 22,395

22,395 –

(6,092) 16,303

224

* Receivables from related parties include loans to Capricorn Capital, Capricorn Hofmeyer and the Share Trust. These loans are unsecured, have no fixed repayment terms and are interest-free. The loan to Capricorn Capital has been subordinated by Capricorn Group to the value of N$ 26.1 million.

** Inventorycomprisesofwork-in-progress.

The notional principal amount of the outstanding interest rate swap contracts, included above and in other liabilities (note 28), at 30 June 2020 was N$173.5 million (2019: N$260.0 million).

Refer to note 3.2.6 for credit quality disclosure of financial instruments included in other assets.