Page 229 - Capricorn IAR 2020

P. 229

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

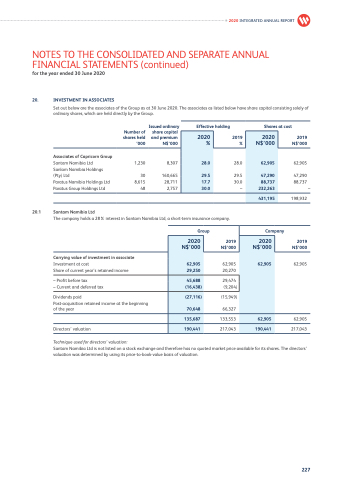

20. INVESTMENT IN ASSOCIATES

Set out below are the associates of the Group as at 30 June 2020. The associates as listed below have share capital consisting solely of ordinary shares, which are held directly by the Group.

Issued ordinary Number of share capital shares held and premium ’000 N$’000

1,230 8,307

30 160,665 8,615 28,711 48 2,757

Effective holding

Shares at cost

2020 %

2019 %

2019 N$’000

62,905

47,290 88,737

–

2020 N$’000

Associates of Capricorn Group

Santam Namibia Ltd

Sanlam Namibia Holdings (Pty) Ltd

Paratus Namibia Holdings Ltd Paratus Group Holdings Ltd

20.1 Santam Namibia Ltd

198,932

2019 N$’000

62,905

62,905 217,043

28.0

29.5

30.0

28.0

29.5 30.0 –

62,905

47,290

17.7

88,737

232,263

431,195

The company holds a 28% interest in Santam Namibia Ltd, a short-term insurance company.

Group

Company

2020 N$’000

29,250

2020 N$’000

62,905

62,905 20,270

62,905

45,688

29,474 (9,204)

(16,438)

(27,116)

70,648

(15,949) 66,327

135,687

190,441

133,553

217,043

62,905

190,441

2019 N$’000

Carrying value of investment in associate

Investment at cost

Share of current year’s retained income

– Profit before tax

– Current and deferred tax

Dividends paid

Post-acquisition retained income at the beginning of the year

Directors’ valuation

Technique used for directors’ valuation:

Santam Namibia Ltd is not listed on a stock exchange and therefore has no quoted market price available for its shares. The directors’ valuation was determined by using its price-to-book-value basis of valuation.

227