Page 231 - Capricorn IAR 2020

P. 231

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

20. INVESTMENT IN ASSOCIATES (continued)

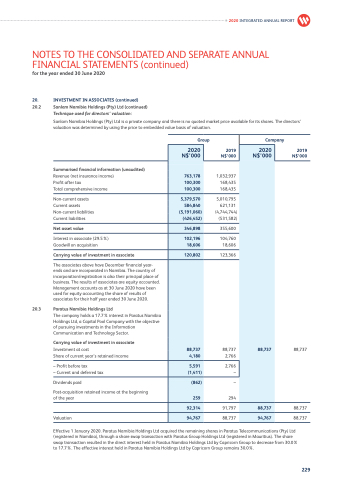

20.2 Sanlam Namibia Holdings (Pty) Ltd (continued)

Technique used for directors’ valuation:

Sanlam Namibia Holdings (Pty) Ltd is a private company and there is no quoted market price available for its shares. The directors’ valuation was determined by using the price to embedded value basis of valuation.

2020 INTEGRATED ANNUAL REPORT

Group

2020 2019 N$’000 N$’000

Company

2019 N$’000

1,032,937 168,435 168,435

5,010,795 621,131

(4,744,744) (531,582)

88,737 2,766

2020 N$’000

355,600

104,760 18,606

123,366

88,737

2,766 –

– 294

91,797

88,737

88,737

94,767

Summarised financial information (unaudited)

Revenue (net insurance income) 763,178 Profit after tax 100,300 Total comprehensive income 100,300

Non-current assets 5,379,570 Current assets 584,840 Non-current liabilities (5,191,060) Current liabilities (426,452)

Net asset value 346,898

Interest in associate (29.5%) 102,196 Goodwill on acquisition 18,606

Carrying value of investment in associate 120,802

The associates above have December financial year- ends and are incorporated in Namibia. The country of incorporation/registration is also their principal place of business. The results of associates are equity accounted. Management accounts as at 30 June 2020 have been used for equity accounting the share of results of associates for their half year ended 30 June 2020.

20.3 Paratus Namibia Holdings Ltd

The company holds a 17.7% interest in Paratus Namibia Holdings Ltd, a Capital Pool Company with the objective of pursuing investments in the Information Communication and Technology Sector.

Carrying value of investment in associate

Investment at cost 88,737 Share of current year’s retained income 4,180

– Profit before tax 5,591 – Current and deferred tax (1,411)

Dividends paid (862) Post-acquisition retained income at the beginning

of the year 259

92,314

Valuation 94,767

88,737

88,737 88,737

Effective 1 January 2020. Paratus Namibia Holdings Ltd acquired the remaining shares in Paratus Telecommunications (Pty) Ltd (registered in Namibia), through a share swap transaction with Paratus Group Holdings Ltd (registered in Mauritius). The share swap transaction resulted in the direct interest held in Paratus Namibia Holdings Ltd by Capricorn Group to decrease from 30.0% to 17.7%. The effective interest held in Paratus Namibia Holdings Ltd by Capricorn Group remains 30.0%.

229