Page 235 - Capricorn IAR 2020

P. 235

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

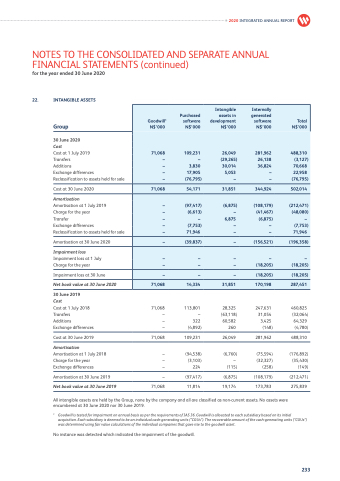

22. INTANGIBLE ASSETS

Group

30 June 2020

Cost

Cost at 1 July 2019

Transfers

Additions

Exchange differences

Reclassification to assets held for sale

Cost at 30 June 2020

Amortisation

Amortisation at 1 July 2019

Charge for the year

Transfer

Exchange differences

Reclassification to assets held for sale

Amortisation at 30 June 2020

Impairment loss

Impairment loss at 1 July Charge for the year

Impairment loss at 30 June

Net book value at 30 June 2020

30 June 2019

Cost

Cost at 1 July 2018

Transfers – Additions –

28,325 (63,118) 60,582

260

26,049

(6,760) –

(115)

(6,875)

19,174

247,631 31,054 3,425

(148)

281,962

(75,594) (32,327) (258)

(108,179)

173,783

460,825 (32,064)

64,329 (4,780)

488,310

(176,892) (35,430) (149)

(212,471)

275,839

Goodwill1 N$’000

Purchased software N$’000

Intangible assets in development N$’000

Internally generated software N$’000

Total N$’000

71,068

109,231

26,049

281,962

488,310

–

–

(29,265)

26,138

(3,127)

–

3,830

30,014

36,824

70,668

–

17,905

5,053

–

22,958

–

(76,795)

–

–

(76,795)

71,068

54,171

31,851

344,924

502,014

–

(97,417)

(6,875)

(108,179)

(212,471)

–

(6,613)

–

(41,467)

(48,080)

–

–

6,875

(6,875)

–

–

(7,753)

–

–

(7,753)

–

71,946

–

–

71,946

–

(39,837)

–

(156,521)

(196,358)

–

–

–

–

–

–

–

–

(18,205)

(18,205)

–

–

–

(18,205)

(18,205)

71,068

14,334

31,851

170,198

287,451

Exchange differences

Cost at 30 June 2019

Amortisation

Amortisation at 1 July 2018 Charge for the year Exchange differences

Amortisation at 30 June 2019

Net book value at 30 June 2019

71,068 109,231

– (94,538) – (3,103) – 224

– (97,417)

71,068 11,814

71,068

– (4,892)

113,801 – 322

All intangible assets are held by the Group, none by the company and all are classified as non-current assets. No assets were encumbered at 30 June 2020 nor 30 June 2019.

1 Goodwill is tested for impairment on annual basis as per the requirements of IAS 36. Goodwill is allocated to each subsidiary based on its initial acquisition. Each subsidiary is deemed to be an individual cash-generating units (“CGUs”). The recoverable amount of the cash-generating units (“CGUs”) was determined using fair value calculations of the individual companies that gave rise to the goodwill asset.

No instance was detected which indicated the impairment of the goodwill.

233