Page 237 - Capricorn IAR 2020

P. 237

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

23. PROPERTY AND EQUIPMENT (continued)

The useful lives of the assets were reviewed during June 2020 and the expectations differ from previous estimates, thus the change is accounted for as a change in estimates under IAS 8. Refer to note 1.3.1(b) for further disclosures.

Details regarding the fixed properties as required in terms of Schedule 4 of the Companies Act of Namibia are available to shareholders at the registered office of the Group. This information will be open for inspection in terms of the provisions of section 120 of the Companies Act of Namibia, 2004. The company does not own any property and equipment.

No assets were encumbered at 30 June 2020 nor 30 June 2019. All property and equipment are classified as non-current assets.

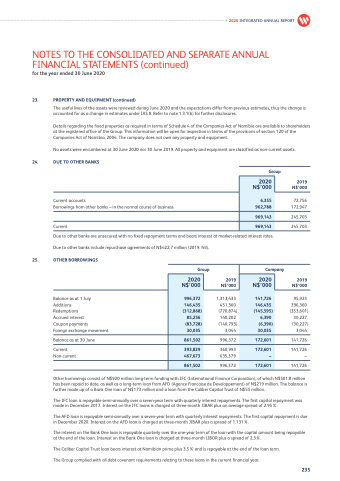

24. DUE TO OTHER BANKS

Current accounts

Borrowings from other banks – in the normal course of business

Group

2020 INTEGRATED ANNUAL REPORT

2020 N$’000

6,355

962,788

969,143

969,143

Current

Due to other banks are unsecured with no fixed repayment terms and bears interest at market-related interest rates.

2019 N$’000

72,756 172,947

245,703 245,703

2019 N$’000

95,923 396,360

(353,601) 30,227

(30,227) 3,044

141,726

141,726 –

141,726

Due to other banks include repurchase agreements of N$422.7 million (2019: Nil).

25. OTHER BORROWINGS

Balance as at 1 July Additions

Redemptions

Accrued interest

Coupon payments

Foreign exchange movement

Balance as at 30 June

Current Non-current

Group

Company

2020 N$’000

2020 N$’000

996,372

146,435

1,313,433 451,360

(770,874) 140,202 (140,793)

3,044

141,726

146,435

(312,868)

(145,595)

85,256

6,390

(83,728)

(6,390)

30,035

30,035

861,502

996,372

172,601

393,829

360,993 635,379

172,601

467,673

–

861,502

996,372

172,601

2019 N$’000

Other borrowings consist of N$920 million long-term funding with IFC (International Finance Corporation), of which N$501.8 million has been repaid to date, as well as a long-term loan from AFD (Agence Francaise de Developpement) of N$219 million. The balance is further made up of a Bank One loan of N$173 million and a loan from the Caliber Capital Trust of N$55 million.

The IFC loan is repayable semi-annually over a seven-year term with quarterly interest repayments. The first capital repayment was made in December 2017. Interest on the IFC loans is charged at three-month JIBAR plus an average spread of 2.95%.

The AFD loan is repayable semi-annually over a seven-year term with quarterly interest repayments. The first capital repayment is due in December 2020. Interest on the AFD loan is charged at three-month JIBAR plus a spread of 1.131%.

The interest on the Bank One loan is repayable quarterly over the one-year term of the loan with the capital amount being repayable at the end of the loan. Interest on the Bank One loan is charged at three-month LIBOR plus a spread of 2.3%.

The Caliber Capital Trust loan bears interest at Namibian prime plus 3.5% and is repayable at the end of the loan term. The Group complied with all debt covenant requirements relating to these loans in the current financial year.

235