Page 239 - Capricorn IAR 2020

P. 239

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

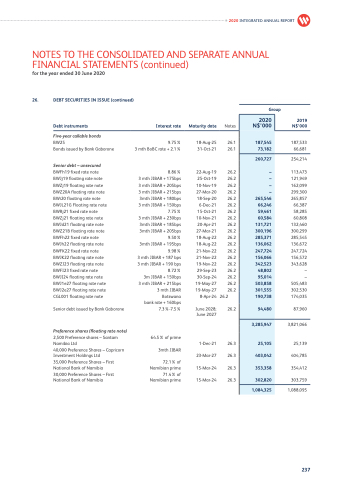

26. DEBT SECURITIES IN ISSUE (continued)

Debt instruments

Five-year callable bonds

Interest rate

Maturity date Notes

18-Aug-25 26.1 31-Oct-21 26.1

22-Aug-19 26.2 25-Oct-19 26.2 10-Nov-19 26.2 27-Mar-20 26.2 18-Sep-20 26.2 6-Dec-21 26.2 15-Oct-21 26.2 10-Nov-21 26.2 20-Apr-21 26.2 27-Mar-21 26.2 18-Aug-22 26.2 18-Aug-22 26.2 21-Nov-22 26.2 21-Nov-22 26.2 19-Nov-22 26.2 29-Sep-23 26.2 30-Sep-24 26.2 19-May-27 26.2 19-May-27 26.2

8-Apr-24 26.2

June 2028; 26.2 June 2027

1-Dec-21 26.3 23-Mar-27 26.3 15-Mar-24 26.3 15-Mar-24 26.3

Group

2020 N$’000

187,545 73,182

260,727

– – – –

265,546 66,246 59,461 60,584

131,721 300,196 285,371 136,062 247,724 156,066 342,523

48,802

95,014 503,858 301,555 190,738

94,480

3,285,947

25,105 403,042 353,358

302,820

1,084,325

2019 N$’000

187,533 66,681

254,214

113,473 121,949 162,099 299,300 265,857

66,387 58,285 60,808

132,460 300,299 285,545 136,672 247,724 156,572 343,628

–

– 505,483 302,530 174,035

87,960

3,821,066

25,139 404,785 354,412 303,759

1,088,095

2020 INTEGRATED ANNUAL REPORT

BW25 9.75%

Bonds issued by Bank Gaborone

Senior debt – unsecured

BWFh19 fixed rate note BWJj19 floating rate note BWZj19 floating rate note BWZ20A floating rate note BWi20 floating rate note BWJL21G Floating rate note BWRj21 fixed rate note BWZj21 floating rate note BWJd21 floating rate note BWZ21B floating rate note BWFh22 fixed rate note BWJh22 floating rate note BWFK22 fixed rate note BWJK22 floating rate note BWZJ23 floating rate note BWFI23 fixed rate note BWJI24 floating rate note BWJ1e27 floating rate note BWJ2e27 floating rate note CGL001 floating rate note

Senior debt issued by Bank Gaborone

Preference shares (floating rate note)

2,500 Preference shares – Santam Namibia Ltd

40,000 Preference Shares – Capricorn Investment Holdings Ltd

35,000 Preference Shares – First National Bank of Namibia 30,000 Preference Shares – First National Bank of Namibia

3 mth BoBC rate + 2.1%

8.86% 3 mth JIBAR + 175bps 3 mth JIBAR + 205bps 3 mth JIBAR + 215bps 3mth JIBAR + 180bps 3 mth JIBAR + 150bps 7.75% 3 mth JIBAR + 230bps 3mth JIBAR + 185bps 3mth JIBAR + 205bps 9.50% 3mth JIBAR + 195bps 9.98% 3 mth JIBAR + 187 bps 3 mth JIBAR + 190 bps 8.72% 3m JIBAR + 150bps 3 mth JIBAR + 215bps 3 mth JIBAR Botswana bank rate + 160bps 7.3%-7.5%

64.5% of prime 3mth JIBAR

72.1% of Namibian prime 71.4% of Namibian prime

237