Page 249 - Capricorn IAR 2020

P. 249

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

33. SHARE–BASED PAYMENTS (continued)

Share appreciation rights (“SAR”) (continued)

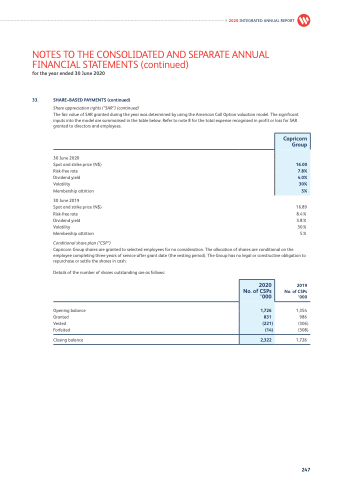

The fair value of SAR granted during the year was determined by using the American Call Option valuation model. The significant inputs into the model are summarised in the table below. Refer to note 8 for the total expense recognised in profit or loss for SAR granted to directors and employees.

30 June 2020

Spot and strike price (N$) Risk-free rate

Dividend yield

Volatility

Membership attrition

30 June 2019

Spot and strike price (N$) 16.89 Risk-free rate 8.4% Dividend yield 3.8% Volatility 30% Membership attrition 5%

Conditional share plan (“CSP”)

Capricorn Group shares are granted to selected employees for no consideration. The allocation of shares are conditional on the employee completing three years of service after grant date (the vesting period). The Group has no legal or constructive obligation to repurchase or settle the shares in cash.

2020 INTEGRATED ANNUAL REPORT

Capricorn Group

16.00

7.8%

4.0%

30%

5%

Details of the number of shares outstanding are as follows:

Opening balance Granted

Vested

Forfeited

Closing balance

2019 No. of CSPs ’000

1,354 986

(306) (308)

1,726

2020 No. of CSPs ’000

1,726

831

(221)

(14)

2,322

247