Page 247 - Capricorn IAR 2020

P. 247

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

31. SHARE CAPITAL AND PREMIUM (continued)

Issued preference share capital

The company has 35,000 Class A and 30,000 Class B preference shares in issue. Interest is payable quarterly in arrears at the end of January, April, July and October. The preference shares are classified as a liability and disclosed in note 26 (debt securities in issue).

Unissued shares

All the unissued shares are under the control of the directors in terms of a general authority to allot and issue them on such terms and conditions and at such time as they deem fit. This authority expires at the forthcoming annual general meeting on 27 October 2020, when the authority can be renewed. Refer to the directors’ report.

The company’s total number of issued ordinary shares at year-end was 519,184,399 (2019: 519,184,399). All issued shares are fully paid up.

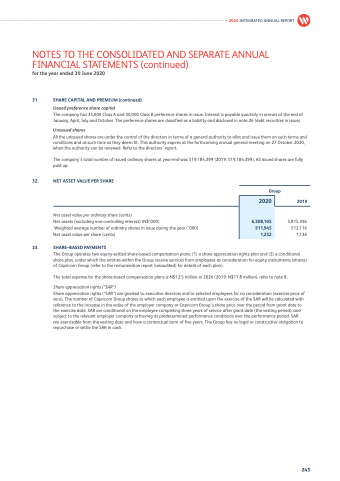

32. NET ASSET VALUE PER SHARE

Net asset value per ordinary share (cents)

Net assets (excluding non-controlling interest) (N$’000)

Weighted average number of ordinary shares in issue during the year (‘000)

Net asset value per share (cents)

33. SHARE–BASED PAYMENTS

Group

2019

5,815,396 512,116 1,136

2020

6,308,105

511,945

1,232

The Group operates two equity-settled share-based compensation plans: (1) a share appreciation rights plan and (2) a conditional share plan, under which the entities within the Group receive services from employees as consideration for equity instruments (shares) of Capricorn Group (refer to the remuneration report (unaudited) for details of each plan).

The total expense for the share-based compensation plans is N$12.5 million in 2020 (2019: N$11.8 million), refer to note 8.

Share appreciation rights (“SAR”)

Share appreciation rights (“SAR”) are granted to executive directors and to selected employees for no consideration (exercise price of zero). The number of Capricorn Group shares to which each employee is entitled upon the exercise of the SAR will be calculated with reference to the increase in the value of the employer company or Capricorn Group’s share price over the period from grant date to the exercise date. SAR are conditional on the employee completing three years of service after grant date (the vesting period), and subject to the relevant employer company achieving its predetermined performance conditions over the performance period. SAR are exercisable from the vesting date and have a contractual term of five years. The Group has no legal or constructive obligation to repurchase or settle the SAR in cash.

245