Page 245 - Capricorn IAR 2020

P. 245

Group

Company

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

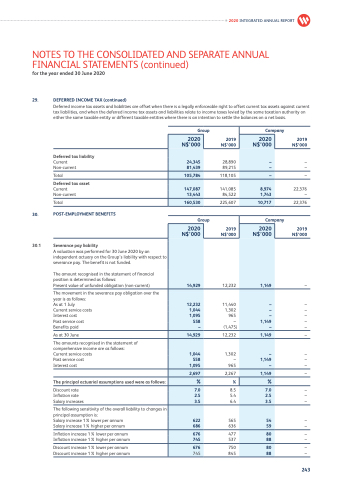

29. DEFERRED INCOME TAX (continued)

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities, and when the deferred income tax assets and liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities where there is an intention to settle the balances on a net basis.

2020 N$’000

2020 N$’000

24,345

81,439

28,890 89,215

–

–

105,784

147,087

118,105

141,085 84,522

8,974

–

13,443

1,743

160,530

225,607

10,717

2019 N$’000

2019 N$’000

– –

–

22,376 –

22,376

2019 N$’000

–

– – – – –

–

– – –

–

– – –

– –

– –

– –

Deferred tax liability

Current Non-current

Total

Deferred tax asset

Current Non-current

Total

30. POST-EMPLOYMENT BENEFITS

30.1 Severance pay liability

A valuation was performed for 30 June 2020 by an independent actuary on the Group’s liability with respect to severance pay. The benefit is not funded.

The amount recognised in the statement of financial position is determined as follows:

Present value of unfunded obligation (non-current)

The movement in the severance pay obligation over the year is as follows:

As at 1 July

Current service costs

Interest cost Past service cost Benefits paid

As at 30 June

The amounts recognised in the statement of comprehensive income are as follows: Current service costs

Past service cost

Interest cost

Group

2020 N$’000

14,929

12,232 1,044 1,095

558 –

14,929

1,044 558 1,095

2,697

Company

2019 N$’000

12,232

2020 N$’000

1,149

11,440 1,302 965 –

(1,475)

1,149

–

–

–

–

12,232

1,302 – 965

1,149

1,149

–

–

2,267

565 636

750 845

%

8.5 5.4 6.4

1,149

%

7.0

2.5

3.5

54

59

477 537

80

88

80

88

The principal actuarial assumptions used were as follows: %

Discount rate Inflation rate Salary increases

The following sensitivity of the overall liability to changes in principal assumption is:

Salary increase 1% lower per annum

Salary increase 1% higher per annum

Inflation increase 1% lower per annum Inflation increase 1% higher per annum

Discount increase 1% lower per annum Discount increase 1% higher per annum

7.0 2.5 3.5

622 686

676 745

676

745

243