Page 244 - Capricorn IAR 2020

P. 244

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

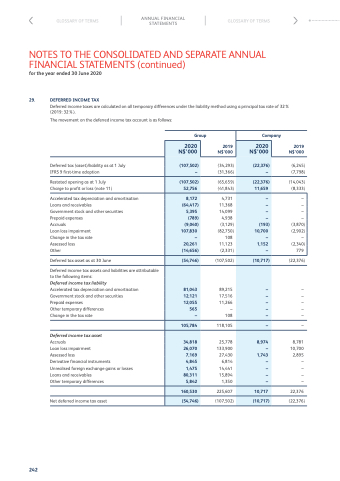

29. DEFERRED INCOME TAX

Deferred income taxes are calculated on all temporary differences under the liability method using a principal tax rate of 32% (2019: 32%).

The movement on the deferred income tax account is as follows:

Group

2020 2019 N$’000 N$’000

Company

2019 N$’000

(6,245) (7,798)

(14,043) (8,333)

(22,376)

– – – – –

–

8,781 10,700 2,895 – – – –

22,376 (22,376)

2020 N$’000

Deferred tax (asset)/liability as at 1 July (107,502) IFRS 9 first-time adoption –

Restated opening as at 1 July (107,502) Charge to profit or loss (note 11) 52,756

Accelerated tax depreciation and amortisation 8,172 Loans and receivables (64,417) Government stock and other securities 5,395 Prepaid expenses (789) Accruals (9,040) Loan loss impairment 107,830 Change in the tax rate – Assessed loss 20,261 Other (14,656)

Deferred tax asset as at 30 June (54,746)

Deferred income tax assets and liabilities are attributable

to the following items:

Deferred income tax liability

Accelerated tax depreciation and amortisation 81,043 Government stock and other securities 12,121 Prepaid expenses 12,055 Other temporary differences 565 Change in the tax rate –

105,784

Deferred income tax asset

Accruals 34,818 Loan loss impairment 26,070 Assessed loss 7,169 Derivative financial instruments 4,845 Unrealised foreign exchange gains or losses 1,475 Loans and receivables 80,311 Other temporary differences 5,842

160,530

Net deferred income tax asset (54,746)

(34,293) (31,366)

(22,376)

–

(22,376)

– – – –

(3,870) (2,902)

– (2,340)

779

242

(65,659) (41,843)

89,215 17,516 11,266

– 108

25,778 133,900 27,430 6,814 14,441 15,894 1,350

(107,502)

11,659

4,731 11,368 14,099

4,938 (3,129) (82,750)

108 11,123

(2,331)

(193)

10,700

1,152

(10,717)

8,974

1,743

10,717

–

–

–

–

–

–

(107,502)

–

–

–

–

–

118,105

–

–

–

–

–

–

225,607

(10,717)