Page 243 - Capricorn IAR 2020

P. 243

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

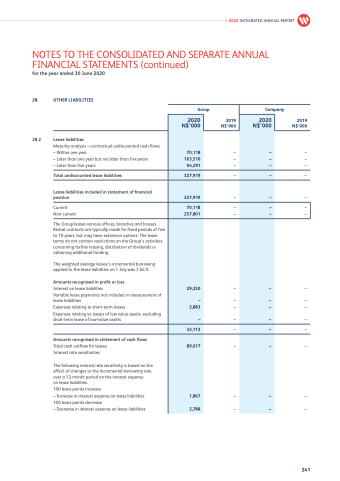

28. OTHER LIABILITIES

28.2 Lease liabilities

Group

2020 2019 N$’000 N$’000

Company

2019 N$’000

– – –

–

–

2020 INTEGRATED ANNUAL REPORT

Maturity analysis – contractual undiscounted cash flows

– Within one year 70,118 – Later than one year but not later than five years 163,510 – Later than five years 94,291

Total undiscounted lease liabilities 327,919

Lease liabilities included in statement of financial

position 327,919

Current 70,118 Non-current 257,801

The Group leases various offices, branches and houses. Rental contracts are typically made for fixed periods of five to 10 years, but may have extension options. The lease terms do not contain restrictions on the Group’s activities concerning further leasing, distribution of dividends or obtaining additional funding.

The weighted average lessee’s incremental borrowing applied to the lease liabilities on 1 July was 7.64%.

Amounts recognised in profit or loss

Interest on lease liabilities 29,230 Variable lease payments not included in measurement of

lease liabilities – Expenses relating to short-term leases 2,883 Expenses relating to leases of low value assets, excluding

short-term lease of low-value assets –

32,113

Amounts recognised in statement of cash flows

Total cash outflow for leases 89,617 – Interest rate sensitivities

The following interest rate sensitivity is based on the effect of changes to the incremental borrowing rate over a 12-month period on the interest expense

on lease liabilities.

100 basis points increase

– Increase in interest expense on lease liabilities 1,867 – 100 basis points decrease

– Decrease in interest expense on lease liabilities 2,788 –

–

– –

– –

–

– –

– – –

–

–

– –

–

– –

–

–

2020 N$’000

–

–

–

–

–

–

–

– –

–

–

–

–

–

–

–

–

241