Page 35 - Capricorn IAR 2020

P. 35

2020 INTEGRATED ANNUAL REPORT

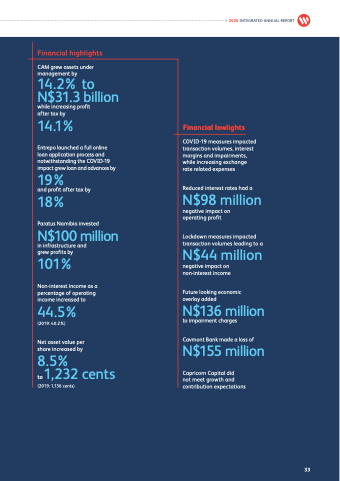

Financial highlights

CAM grew assets under management by

14.2% to

N$31.3 billion

while increasing profit after tax by

14.1% Financial lowlights

Entrepo launched a full online loan application process and notwithstanding the COVID-19 impact grew loan and advances by

19%

and profit after tax by

18%

Paratus Namibia invested

N$100 million

in infrastructure and grew profits by

101%

Non-interest income as a percentage of operating income increased to

44.5%

(2019: 40.2%)

Net asset value per share increased by

(2019: 1,136 cents)

COVID-19 measures impacted transaction volumes, interest margins and impairments, while increasing exchange rate related expenses

Reduced interest rates had a

N$98 million

negative impact on operating profit

Lockdown measures impacted transaction volumes leading to a

N$44 million

negative impact on non-interest income

Future looking economic overlay added

N$136 million

to impairment charges Cavmont Bank made a loss of

N$155 million

Capricorn Capital did

not meet growth and contribution expectations

8.5%

to

1,232 cents

33