Page 36 - Capricorn IAR 2020

P. 36

GROUP CEO’S REPORT FINANCIAL DIRECTOR’S REVIEW STRATEGY AND MATERIAL MATTERS

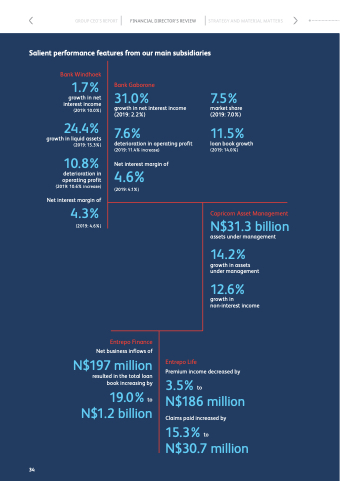

Salient performance features from our main subsidiaries

Bank Windhoek

1.7%

growth in net interest income (2019: 10.0%)

24.4%

growth in liquid assets (2019: 15.3%)

10.8%

4.6%

(2019: 4.1%)

4.3%

(2019: 4.6%)

deterioration in operating profit (2019: 10.6% increase)

Net interest margin of

Bank Gaborone

31.0%

growth in net interest income (2019: 2.2%)

7.6%

deterioration in operating profit (2019: 11.4% increase)

Net interest margin of

7.5%

market share (2019: 7.0%)

11.5%

loan book growth (2019: 14.0%)

Capricorn Asset Management

N$31.3 billion

assets under management

14.2%

growth in assets under management

12.6%

growth in non-interest income

34

Entrepo Finance

Net business inflows of

N$197 million

resulted in the total loan book increasing by

19.0% N$1.2 billion

Entrepo Life

to

Premium income decreased by

3.5%

N$186 million

Claims paid increased by

15 . 3% t o N$30.7 million

to