Page 38 - Capricorn IAR 2020

P. 38

GROUP CEO’S REPORT FINANCIAL DIRECTOR’S REVIEW STRATEGY AND MATERIAL MATTERS

Net interest income

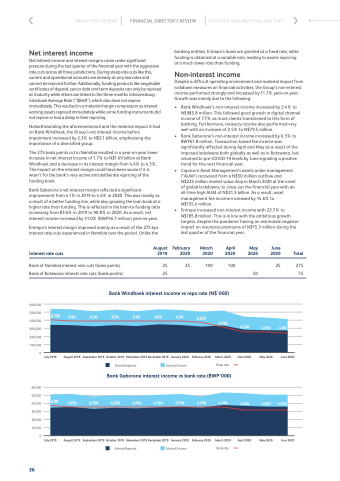

Net interest income and interest margins came under significant pressure during the last quarter of the financial year with the aggressive rate cuts across all three jurisdictions. During steep rate cuts like this, current and operational accounts are already at very low rates and cannot be repriced further. Additionally, funding products like negotiable certificates of deposit, senior debt and term deposits can only be repriced at maturity while others are linked to the three months Johannesburg Interbank Average Rate (“JIBAR”), which also does not reprice immediately. This resulted in a material margin compression as interest earning assets repriced immediately while some funding instruments did not reprice or had a delay in their repricing.

Notwithstanding the aforementioned and the material impact it had on Bank Windhoek, the Group’s net interest income before impairment increased by 2.3% to N$2.1 billion, emphasising the importance of a diversified group.

The 275 basis points cut in Namibia resulted in a year-on-year lower increase in net interest income of 1.7% to N$1.69 billion at Bank Windhoek and a decrease in its interest margin from 4.6% to 4.3%. The impact on the interest margin could have been worse if it is wasn’t for the bank’s very active and deliberate repricing of the funding book.

Bank Gaborone’s net interest margin reflected a significant improvement from 4.1% in 2019 to 4.6% in 2020. This was mainly as a result of a better funding mix, while also growing the loan book at a higher rate than funding. This is reflected in the loan-to-funding ratio increasing from 83.6% in 2019 to 90.8% in 2020. As a result, net interest income increased by 31.0% (BWP56.7 million) year-on-year.

Entrepo’s interest margin improved mainly as a result of the 275 bps interest rate cuts experienced in Namibia over the period. Unlike the

August Interest rate cuts 2019

Bank of Namibia interest rate cuts (basis points) 25 Bank of Botswana interest rate cuts (basis points) 25

banking entities, Entrepo’s loans are granted at a fixed rate, while funding is obtained at a variable rate, leading to assets repricing at a much lower rate than funding.

Non-interest income

Despite a difficult operating environment and material impact from lockdown measures on financial activities, the Group’s non-interest income performed strongly and increased by 11.7% year-on-year. Growth was mainly due to the following:

• Bank Windhoek’s non-interest income increased by 2.4% to N$985.8 million. This followed good growth in digital channel income of 7.7% as more clients transitioned to this form of banking. Furthermore, treasury income also performed very well with an increase of 2.5% to N$79.5 million.

• Bank Gaborone’s non-interest income increased by 6.3% to BWP61.8 million. Transaction-based fee income was significantly affected during April and May as a result of the imposed lockdowns both globally as well as in Botswana, but returned to pre-COVID-19 levels by June signaling a positive trend for the next financial year.

• Capricorn Asset Management’s assets under management (“AUM”) recovered from a N$50 million outflow and N$225 million market value drop in March 2020 at the onset of global lockdowns, to close out the financial year with an all-time high AUM of N$31.3 billion. As a result, asset management fee income increased by 14.6% to

N$135.4 million.

• Entrepo increased non-interest income with 22.7% to

N$185.8 million. This is in line with the ambitious growth targets, despite the pandemic having an estimated negative impact on insurance premiums of N$15.3 million during the last quarter of the financial year.

February 2020

25

March April 2020 2020

100 100

May 2020

June 2020

Total

50

25

4.0%

June 2020

275 75

600,000 500,000 400,000 300,000 200,000 100,000

0

60,000 50,000 40,000 30,000 20,000 10,000

0

6.75%

6.5%

August 2019

6.5% 6.5% 6.5%

6.5%

6.5%

January 2020

6.25%

5.25%

Bank Windhoek interest income vs repo rate (N$’000)

July 2019

September 2019 October 2019

November 2019 December 2019

February 2020

March 2020

Repo rate

4.25%

April 2020

4.25%

May 2020

Interest Expense Interest Income

Bank Gaborone interest income vs bank rate (BWP’000)

5.0% 4.75% 4.75% 4.75% 4.75% 4.75% 4.75% 4.75% 4.75% 4.25% 4.25% 4.25%

July 2019

August 2019

September 2019 October 2019 November 2019 December 2019 January 2020

February 2020

March 2020

April 2020

May 2020

June 2020

Interest Expense Interest Income

Bank rate

36