Page 101 - 5D.Charlotte.Sydney

P. 101

*

Exchanges Out

Free Credit Balance

Accrued Interest (AI)

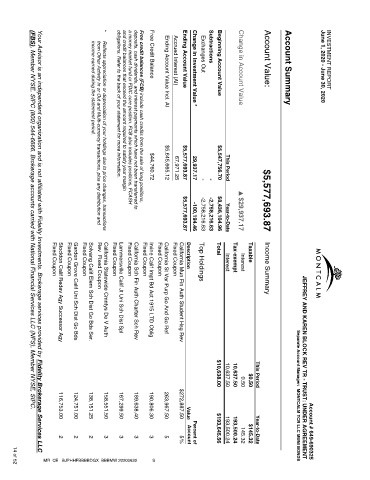

Account Value:

Beginning Account Value

Change in Account Value

Ending Account Value Incl. AI

income earned during the statement period.

obligations. Refer to the back of your statement for more information.

29,937.17

$5,577,693.87

$5,645,665.12

$5,547,756.70

$44,760.72

-

-

and credit balances that exceed the amount required to satisfy your margin

a money market fund or FDIC core position. FCB also includes positions, FCASH

deposits, cash dividends, and interest payments which have not been transferred to

from Other Activity In or Out and Multi-currency transactions, plus any distribution and

Reflects appreciation or depreciation of your holdings due to price changes, transactions

$8,436,104.96

-100,194.46

-2,758,216.63

$5,577,693.87

-2,758,216.63

Year-to-Date

Interest

Interest

Fixed Coupon

Fixed Coupon

Fixed Coupon

Fixed Coupon

Fixed Coupon

Rev Fixed Coupon

Income Summary

Lammersville Calif Jt Uni Sch Dist Spl

California Statewide Cmntys De V Auth

Garden Grove Calif Uni Sch Dist Go Bds

Solvang Calif Elem Sch Dist Go Bds Ser.

Stockton Calif Redev Agy Successor Agy

10,637.50

0.50

10,637.50

$0.50

$10,638.00

(FBS), Member NYSE, SIPC (800) 544-6666. Brokerage accounts carried with National Financial Services LLC (NFS), Member NYSE, SIPC.

167,299.50

$272,887.50

263,967.50

189,638.40

124,751.00

116,753.00

190,806.30

138,151.25

158,551.50

Value

3

2

3

3

3

2

5

2

5%

145.32

$145.32

193,500.24

$193,645.56

193,500.24

Account

Year-to-Date

Percent of

Your Advisor is an independent organization and is not affiliated with Fidelity Investments. Brokerage services provided by Fidelity Brokerage Services LLC

MR_CE _BJPHHFBBBBDGX_BBBMW 20200630 California Sch Fin Auth Charter Sch Rev Free credit balances (FCB) include cash credits from the sale of long positions, Fixed Coupon Irvine Calif Impt Bd Act 1915 LTD Oblig S Fixed Coupon California St Var Purp Go And Go Ref Fixed Coupon 67,971.25 California Mun Fin Auth Student Hsg Rev Ending Account Value Description Change in Investment Value * Top Holdings Subtractions Total This Period Tax-exempt $29,937.1

14 of 52