Page 144 - 5D.Charlotte.Sydney

P. 144

Sale

Sale

Sale

Sale

Sale

Sale

Sale

Sale

Sale

Sale

Sale

Sale

Action

TOTALS

Subtotals

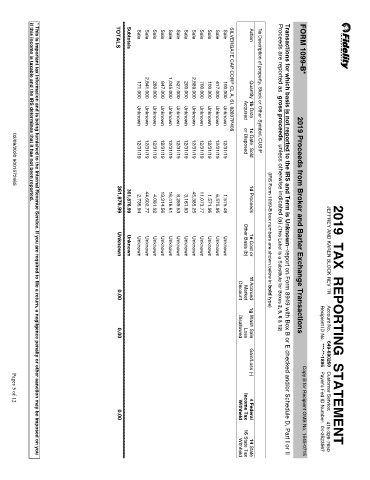

FORM 1099-B*

SILVERGATE CAP CORP CL A,

847.000

527.000

417.000

200.000

171.000

100.000

1,045.000

100.000

700.000

260.000

Quantity

2,889.000

2,841.000

SI,

Transactions for which basis

1b Date

Acquired

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

82837P408

1a Description of property, Stock or Other Symbol, CUSIP

or Disposed

1c Date Sold

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

12/31/19

02/09/2020 9001572465

if this income is taxable and the IRS determines that it has not been reported.

11,073.77

1,571.96

361,876.99

16,416.61

1,575.46

8,289.53

13,314.56

44,602.77

4,081.92

2,735.94

6,575.95

45,385.25

1d Proceeds

361,876.99

3,161.93

Unknown

Unknown

1e Cost or

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Unknown

Other Basis (b)

JEFFREY AND KAREN BLOCK REV TR

0.00

Discount

1f Accrued

Market

(IRS Form 1099-B box numbers are shown below in bold type)

Proceeds are reported as gross proceeds unless otherwise indicated (a).(This Label is a Substitute for Boxes 2, 5, 6 & 12)

Account No.

2019 Proceeds from Broker and Barter Exchange Transactions

Loss

1g Wash Sale

0.00

Disallowed

Recipient ID No.

649-690260

***-**-1895

Gain/Loss (-)

Pages 5 of 12

Customer Service:

4 Federal

0.00

Income Tax

Withheld

Payer's Fed ID Number:

2019 TAX REPORTING STATEMENT

415-326-7650

04-3523567

is not reported to the IRS and Term is Unknown--report on Form 8949 with Box B or E checked and/or Schedule D, Part I or II

* This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed on you

Copy B for Recipient OMB No. 1545-0715

14 State

Withheld

16 State Tax

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -