Page 88 - Bahrain Gov Annual Reports (II)_Neat

P. 88

6

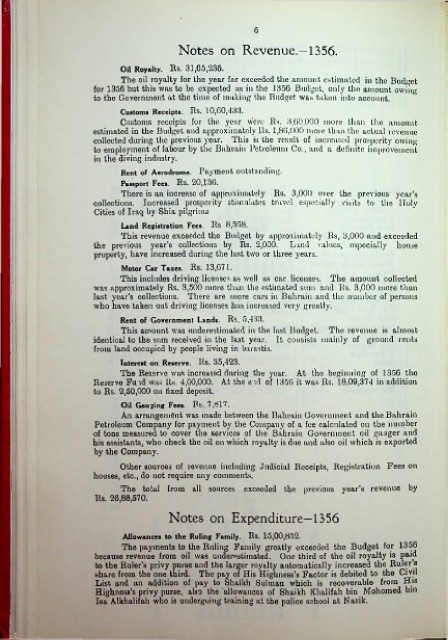

Notes on Revenue.—1356.

Oil Royalty. Rs. 31,65,235.

The oil royalty for the year far exceeded the amount estimated in the Budget

for 1356 but this was to be expected as in the 1356 Budget, only the amount owing

to the Government at the time of making the Budget was taken into account.

Customs Receipts. Rs. 10,60/133.

Customs receipts for the year were 11s. '3,60,000 more than the amount

estimated in the Budget and approximately 11s. 1,86,000 more than the actual revenue

collected during the previous year. This is the result of increased prosperity owing

to employment of labour by the Bahrain Petroleum Co., and a definite improvement

in the diving industry.

Rent of Aerodrome. Payment outstanding.

Passport Fees. Rs. 20,136.

There is an increase of approximately Us. 3,000 over the previous year’s

collections. Increased prosperity stimulates travel especially visits to the Holy

Cities of Iraq by Shia pilgrims

Land Registration Fees. Rs. 8,358.

This revenue exceeded the Budget by approximately Ils, 3,000 and exceeded

the previous year’s collections by Rs. 2,000. Land values, especially house

property, have increased during the last two or three years.

Motor Car Taxes. Rs. 13,671.

This includes driving licenses as well as car licenses. The amount collected

was approximately Rs. 3,500 more than the estimated sum and Rs. 3,000 more than

last year’s collections. There are more cars in Bahrain and the number of persons

who have taken out driving licenses has increased very greatly.

Rent of Government Lands. Rs, 5,433.

This amount was underestimated in the last Budget. The revenue is almost

identical to the sum received in the last year. It consists mainly of ground rents

from land occupied by people living in barastis.

Interest on Reserve. Rs. 35,423.

The Reserve was increased during the year. At the beginning of 1356 the

Reserve Fuid was Us. 4,00,000. At the end of 1356 it was Rs. 18,09,374 in addition

to Rs. 2,50,000 on fixed deposit.

Oil Gauging Fees. Rs. 7,817.

An arrangement was made between the Bahrain Government and the Bahrain

Petroleum Company for payment by the Company of a fee calculated on the number

of tons measured to cover the services of the Bahrain Government oil gauger and

his assistants, who check the oil on which royalty is due and also oil which is exported

by the Company.

Other sources of revenue including Judicial Receipts, Registration Fees on

houses, etc., do not require any comments.

The total from all sources exceeded the previous year’s revenue by

Rs. 26,88,570.

Notes on Expenditure—1356

Allowances to the Ruling Family. Rs. 15,00,852.

The payments to the Ruling Family greatly exceeded the Budget for 1356

because revenue from oil was underestimated. One third of the oil royalty is paid

to the Ruler’s privy purse and the larger royalty automatically increased the Ruler s

share from the one third. The pay of His Highness’s Factor is debited to the Civil

List and an addition of pay to Shaikh Sulman which is recoverable from His

Highness’s privy purse, also the allowances of Shaikh Khalifah bin Mohomed bin

Isa Alkhalifah who is undergoing training at the police school at Nasik.

■