Page 60 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 60

57

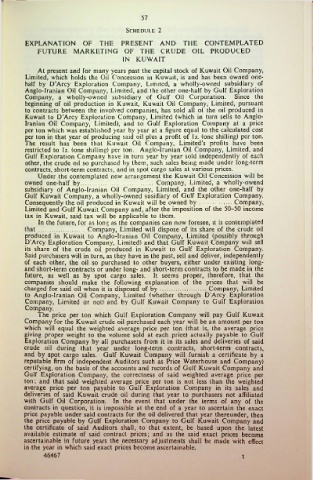

Schedule 2

EXPLANATION OF THE PRESENT AND THE CONTEMPLATED

FUTURE MARKETING OF THE CRUDE OIL PRODUCED

IN KUWAIT

At present and for many years past the capital stock of Kuwait Oil Company,

Limited, which holds the Oil Concession in Kuwait, is and has been owned one-

half by D’Arcy Exploration Company, Limited, a wholly-owned subsidiary of

Anglo-Iranian Oil Company, Limited, and the other one-half by Gulf Exploration

Company, a wholly-owned subsidiary of Gulf Oil Corporation. Since the

beginning of oil production in Kuwait, Kuwait Oil Company, Limited, pursuant

to contracts between the involved companies, has sold all of the oil produced in

Kuwait to D’Arcy Exploration Company, Limited (which in turn sells to Anglo-

Iranian Oil Company, Limited), and to Gulf Exploration Company at a price

per ton which was established year by year at a figure equal to the calculated cost

per ton in that year of producing said oil plus a profit of Is. (one shilling) per ton.

The result has been that Kuwait Oil Company, Limited’s profits have been

restricted to Is. (one shilling) per ton. Anglo-Iranian Oil Company, Limited, and

Gulf Exploration Company have in turn year by year sold independently of each

other, the crude oil so purchased by them, such sales being made under long-term

contracts, short-term contracts, and in spot cargo sales at various prices.

Under the contemplated new arrangement the Kuwait Oil Concession will be

owned one-half by.......................................... Company, Limited, a wholly-owend

subsidiary of Anglo-Iranian Oil Company, Limited, and the other one-half by

Gulf Kuwait Company, a wholly-owned susidiary of Gulf Exploration Company.

Consequently the oil produced in Kuwait will be owned by.................. 1 Company,

Limited and Gulf Kuwait Company and, after the imposition of the 50-50 income

tax in Kuwait, said tax will be applicable to them.

In the future, for as long as the companies can now foresee, it is contemplated

that .......................... Company, Limited will dispose of its share of the crude oil

produced in Kuwait to Anglo-Iranian Oil Company, Limited (possibly through

D’Arcy Exploration Company, Limited) and that Gulf Kuwait Company will sell

its share of the crude oil produced in Kuwait to Gulf Exploration Company.

Said purchasers will in turn, as they have in the past, sell and deliver, independently

of each other, the oil so purchased to other buyers, either under existing long-

and short-term contracts or under long- and short-term contracts to be made in the

future, as well as by spot cargo sales. It seems proper, therefore, that the

companies should make the following explanation of the prices that will be

charged for said oil when it is disposed of by .......................... Company, Limited

to Anglo-Iranian Oil Company, Limited (whether through D’Arcy Exploration

Company, Limited or not) and by Gulf Kuwait Company to Gulf Exploration

Company.

The price per ton which Gulf Exploration Company will pay Gulf Kuwait

Company for the Kuwait crude oil purchased each year will be an amount per ton

which will equal the weighted average price per ton (that is, the average price

giving proper weight to the volume sold at each price) actually payable to Gulf

Exploration Company by all purchasers from it in its sales and deliveries of said

crude oil during that year under long-term contracts, short-term contracts,

and by spot cargo sales. Gulf Kuwait Company will furnish a certificate by a

reputable firm of independent Auditors such as Price Waterhouse and Company)

certifying, on the basis of the accounts and records of Gulf Kuwait Company and

Gulf Exploration Company, the correctness of said weighted average price per

ton; and that said weighted average price per ton is not less than the weighted

average price per ton payable to Gulf Exploration Company in its sales and

deliveries of said Kuwait crude oil during that year to purchasers not affiliated

with Gulf Oil Corporation. In the event that under the terms of any of the

contracts in question, it is impossible at the end of a year to ascertain the exact

price payable under said contracts for the oil delivered that year thereunder, then

the price payable by Gulf Exploration Company to Gulf Kuwait Company and

the certificate of said Auditors shall, to that extent, be based upon the latest

available estimate of said contract prices; and as the said exact prices become

ascertainable in future years the necessary adjustments shall be made with effect

in the year in which said exact prices become ascertainable.

46467 I