Page 48 - The Persian Gulf Historical Summaries (1907-1953) Vol III_Neat

P. 48

44

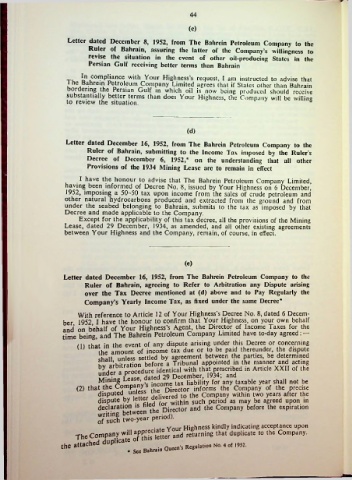

(c)

Letter dated December 8, 1952, from The Bahrein Petroleum Company i. __

to the

Ruler of Bahrain, assuring the latter of the Company’s willingness to

revise the situation in the event of other oil-producing States in the

Persian Gulf receiving better terms than Bahrain

T. Jn compliance with Your Highness’s request, I am instructed to advise that

Ihc Bahrein Pctroicum Company Limited agrees that if States other than Bahrain

bordering he Person Gulf in which oil is now being produced should receive

substantially better terms than does Your Highness, the Company will be willin'*

to review the situation. °

(d)

Letter dated December 16, 1952, from The Bahrein Pctroicum Company to the

Ruler of Bahrain, submitting to the Income Tax imposed by the Ruler’s

Decree of December 6, 1952,* on the understanding that all other

Provisions of the 1934 Mining Lease are to remain in effect

I have the honour to advise that The Bahrein Petroleum Company Limited,

having been informed of Decree No. 8, issued by Your Highness on 6 December,

1952, imposing a 50-50 tax upon income from the sales of crude petroleum and

other natural hydrocarbons produced and extracted from the ground and from

under the seabed belonging to Bahrain, submits to the tax as imposed by that

Decree and made applicable to the Company.

Except for the applicability of this tax decree, all the provisions of the Mining

Lease, dated 29 December, 1934, as amended, and all other existing agreements

between Your Highness and the Company, remain, of course, in effect.

(e)

Letter dated December 16, 1952, from The Bahrein Petroleum Company to the

Ruler of Bahrain, agreeing to Refer to Arbitration any Dispute arising

over the Tax Decree mentioned at (d) above and to Pay Regularly the

Company’s Yearly Income Tax, as fixed under the same Decree*

With reference to Article 12 of Your Highness’s Decree No. 8, dated 6 Decem

ber 1952 I have the honour to confirm that Your Highness, on your own behalf

and on behalf of Your Highness’s Agent, the Director of Income Taxes for the

time being, and The Bahrein Petroleum Company Limited have to-day agreed: —

m that in the event of any dispute arising under this Decree or concerning

the amount of income tax due or to be paid thereunder, the dispute

'hall unless settled by agreement between the parties, be determined

r"Vrhitration before a Tribunal appointed in the manner and acting

Sder a procedure identical with that prescribed in Article XXII of the

T Mse dated 29 December, 1934; and

Mining Le. tax liability for any taxable year shall not be

(2) that the Company s neome eax j the Company of the precise

disputed unless the Dtrec or within two years after the

dispute by lett= ^e 'Vrer®-thin such period as may be agreed upon in

declaration is hlecM Director and the Company before the expiration

ofrS two-year period).

• Your Highness kindly indicating acceptance upon

The Company will aPPr«cl£tter and retUrning that duplicate to the Company,

the attached duplicate of

n’s Regulation No. 4 of 1952.

* See Bahrain Qucc