Page 62 - The Persian Gulf Historical Summaries (1907-1953) Vol III_Neat

P. 62

58

Since the Anglo-Iranian Oil Company, Limited sells a large proportion of its

Kuwait crude oil cither to refineries owned by it (where the oil becomes mingled

with other crudes) or on special long-term contracts, the Anglo-Iranian Oil

Company, Limited is prepared to accept that the price per ton payable by Gulf

Exploration Company to the Gulf Kuwait Company (as set out above) represents

as fair and correct a valuation of Kuwait crude oil as it is possible to obtain for the

purposes of Kuwait income tax and for its part is also prepared to accept that an

identical price shall be utilised when the .............................. Company disposes of

its crude oil to the Anglo-Iranian Oil Company, Limited (whether through the

D’Arcy Exploration Company, Limited or not) irrespective of the price at which

the Anglo-Iranian Oil Company. Limited may eventually sell that crude oil.

Anglo-Iranian Oil Company, Limited trusts that His Highness the Ruler of Kuwait

and the Kuwait Income Tax authorities will also accept such a price as representing

the fair and correct valuation of the Kuwait crude oil sold by ..............................

Company, Limited in any year and requests assurances from His Highness that

this will be so.

London,

June 20th, 1951.

Note.—" Company Limited ” referred to above is Kuwait

Oil Company Limited whose name now is or shortly will be D’Arcy Kuwait

Company Limited, now a wholly-owned subsidiary of Anglo-Iranian Oil Company

Limited.

(c)

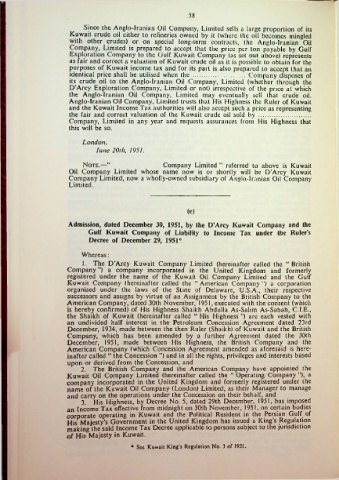

Admission, dated December 30, 1951, by the D’Arcy Kuwait Company and the

Gulf Kuwait Company of Liability to Income Tax under the Ruler’s

Decree of December 29, 1951*

Whereas:

1. The D’Arcy Kuwait Company Limited (hereinafter called the “ British

Company ”) a company incorporated in the United Kingdom and formerly

registered under the name of the Kuwait Oil Company Limited and the Gulf

Kuwait Company (hereinafter called the “ American Company ”) a corporation

organised under the laws of the State of Delaware, U.S.A., their respective

successors and assigns by virtue of an Assignment by the British Company to the

American Company, dated 30th November, 1951, executed with the consent (which

is hereby confirmed) of His Highness Shaikh Abdulla As-Salim As-Sabah, C.I.E.,

the Shaikh of Kuwait (hereinafter called “ His Highness ”) are each vested with

an undivided half interest in the Petroleum Concession Agreement dated 23rd

December, 1934, made between the then Ruler (Shaikh) of Kuwait and the British

Company, which has been amended by a further Agreement dated the 30th

December, 1951, made between His Highness, the British Company and the

American Company (which Concession Agreement amended as aforesaid is here

inafter called “ the Concession ”) and in all the rights, privileges and interests based

upon or derived from the Concession, and

2. The British Company and the American Company have appointed the

Kuwait Oil Company Limited (hereinafter called the “ Operating Company ”), a

company incorporated in the United Kingdom and formerly registered under the

name of the Kuwait Oil Company (London) Limited, as their Manager to manage

and carry on the operations under the Concession on their behalf, and

3. His Highness, by Decree No. 5, dated 29th December, 1951, has imposed

an Income Tax effective from midnight on 30th November, 1951, on certain bodies

corporate operating in Kuwait and the Political Resident in the Persian Gulf of

His Majesty’s Government in the United Kingdom has issued a King’s Regulation

making the said Income Tax Decree applicable to persons subject to the jurisdiction

of His Majesty in Kuwait.

• See Kuwait King’s Regulation No. 3 of 1951.