Page 327 - Bahrain Gov Annual Reports (III)_Neat

P. 327

47

The Muharraq Municipality was formed in 1346 (1927) without opposition, its constitution

was based on that of Manama but its council was smaller and its responsibilities and revenue were

less than those of Manama. The first President was Shaikh Abdulla bin Isa but when he took over

the presidency of Manama he was succeeded by Shaikh Abdulla bin Hamed who still presides over

the council.

From 1353 (1934) the Government made a contribution to the Muharraq Municipality for work

in Hcdd, the third largest town in Bahrain, which was administered by a municipal sub-committee

which included two co-opted members from Hedd. In 1364 (1945) a regular municipality with a

council of nominated and elected members was set up in Hedd under the presidency of Shaikh Rashid

bin Khalifah, a minor member of the Ruling Family. Arrangements are now being made to form a

municipality in the two Rafaas.

Municipal Finance.—Municipal revenue is derived from a tax on houses and shops, a subsidy

from the Government, half of the proceeds of the vehicle tax which is collected by the State and various

municipal fees and licences. When the first municipality was formed, in Manama, most of its income

came from a special tax which was collected on all imports into Bahrain known as the Baladiya tax,

this was found to be unsatisfactory and a Government subsidy was substituted for the import tax.

Municipal councillors have always shown the greatest reluctance to impose any form of direct taxation

though willing to approve of indirect taxation, for the benefit of the municipality, especially if by so

doing the existing house and shop tax could be done away with, but the Government contends that

municipalities should rely chiefly on municipal income and should not be so heavily dependent on

the Government for their normal revenue though frequently the Government makes grants to the

municipalities for special projects.

Methods of taxation varied in Manama and Muharraq; in Manama the tax on houses which

were let was assessed according to the rent at i$as. in the rupee, houses occupied by their owners

paid according to an old assessment whose basis has never been clearly revealed, but neither the size

of the house nor the financial position of the owner appeared to have any bearing on the scale of the

tax, large blocks of buildings covering an extensive area and containing twenty or thirty rooms, owned

by wealthy merchants, paid Rs. 2 p.m. while four roomed flats, above shops, leased usually by foreign

ers, paid house tax in proportion to the exorbitant rents which were charged by the landlords.

In Muharraq all houses and shops were divided into a number of classes according to the size of the

premises and each grade was liablp for a certain tax, but only half a dozen houses in town paid the

tax of the top grade, which was Rs. 5 p.m. Property of the Ruling Family and their servants and

retainers was immune from tax ; in Muharraq about 1,000 out of a total of 4,600 houses of which 4,000

were stone and 600 barastis, enjoyed tax immunity. At various times the Government has taken

up the question of municipal taxation with the Manama and Muharraq councils and eventually a

reassessment was made of all houses occupied by their owners with a view to fixing rates of taxation

for these premises which should be more in line with the taxes paid on rented houses.

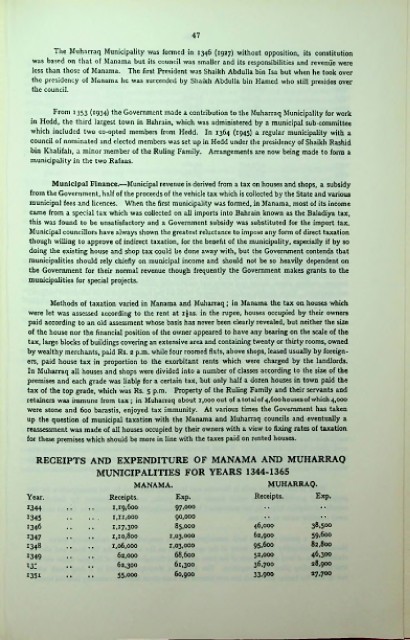

RECEIPTS AND EXPENDITURE OF MANAMA AND MUHARRAQ

MUNICIPALITIES FOR YEARS 1344-1365

MANAMA. MUHARRAQ.

Year. Receipts. Exp. Receipts. Exp.

1344 1,19,600 97.000

1345 1.11.000 90.000

1346 1.17.300 85.000 46.000 38.500

1347 1,10,800 1,03,000 62.900 59.600

1348 1.06.000 1,03,000 95.6oo 82,800

1349 62.000 68,600 52.000 46.300

13: 62,300 61,300 36.700 28,900

1351 55.000 60,900 33.900 27.700