Page 19 - Annual Report 2017

P. 19

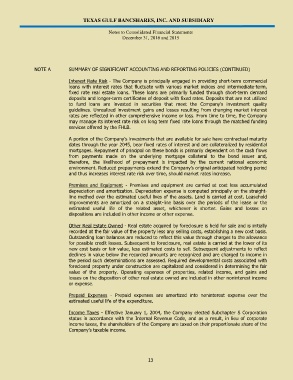

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

NOTE A SUMMARY OF SIGNIFICANT ACCOUNTING AND REPORTING POLICIES (CONTINUED)

Interest Rate Risk - The Company is principally engaged in providing short-term commercial

loans with interest rates that fluctuate with various market indices and intermediate-term,

fixed rate real estate loans. These loans are primarily funded through short-term demand

deposits and longer-term certificates of deposit with fixed rates. Deposits that are not utilized

to fund loans are invested in securities that meet the Company’s investment quality

guidelines. Unrealized investment gains and losses resulting from changing market interest

rates are reflected in other comprehensive income or loss. From time to time, the Company

may manage its interest rate risk on long term fixed rate loans through the matched funding

services offered by the FHLB.

A portion of the Company’s investments that are available for sale have contractual maturity

dates through the year 2045, bear fixed rates of interest and are collateralized by residential

mortgages. Repayment of principal on these bonds is primarily dependent on the cash flows

from payments made on the underlying mortgage collateral to the bond issuer and,

therefore, the likelihood of prepayment is impacted by the current national economic

environment. Reduced prepayments extend the Company’s original anticipated holding period

and thus increases interest rate risk over time, should market rates increase.

Premises and Equipment - Premises and equipment are carried at cost less accumulated

depreciation and amortization. Depreciation expense is computed principally on the straight-

line method over the estimated useful lives of the assets. Land is carried at cost. Leasehold

improvements are amortized on a straight-line basis over the periods of the lease or the

estimated useful life of the related asset, whichever is shorter. Gains and losses on

dispositions are included in other income or other expense.

Other Real Estate Owned - Real estate acquired by foreclosure is held for sale and is initially

recorded at the fair value of the property less any selling costs, establishing a new cost basis.

Outstanding loan balances are reduced to reflect this value through charges to the allowance

for possible credit losses. Subsequent to foreclosure, real estate is carried at the lower of its

new cost basis or fair value, less estimated costs to sell. Subsequent adjustments to reflect

declines in value below the recorded amounts are recognized and are charged to income in

the period such determinations are assessed. Required developmental costs associated with

foreclosed property under construction are capitalized and considered in determining the fair

value of the property. Operating expenses of properties, related income, and gains and

losses on the disposition of other real estate owned are included in other noninterest income

or expense.

Prepaid Expenses - Prepaid expenses are amortized into noninterest expense over the

estimated useful life of the expenditure.

Income Taxes - Effective January 1, 2004, the Company elected Subchapter S Corporation

status in accordance with the Internal Revenue Code, and as a result, in lieu of corporate

income taxes, the shareholders of the Company are taxed on their proportionate share of the

Company’s taxable income.

13