Page 30 - 2018 Apple Annual Report

P. 30

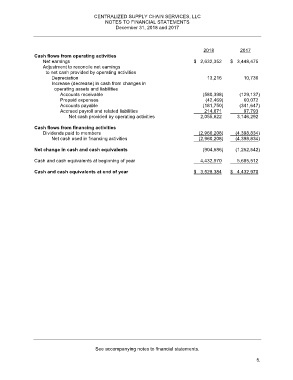

CENTRALIZED SUPPLY CHAIN SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

December 31, 2018 and 2017

2018 2017

Cash flows from operating activities

Net earnings $ 2,632,352 $ 3,448,475

Adjustment to reconcile net earnings

to net cash provided by operating activities

Depreciation 13,216 10,736

Increase (decrease) in cash from changes in

operating assets and liabilities

Accounts receivable (580,398) (129,137)

Prepaid expenses (42,469) 60,072

Accounts payable (181,750) (341,647)

Accrued payroll and related liabilities 214,671 97,793

Net cash provided by operating activities 2,055,622 3,146,292

Cash flows from financing activities

Dividends paid to members (2,960,208) (4,398,834)

Net cash used in financing activities (2,960,208) (4,398,834)

Net change in cash and cash equivalents (904,586) (1,252,542)

Cash and cash equivalents at beginning of year 4,432,970 5,685,512

Cash and cash equivalents at end of year $ 3,528,384 $ 4,432,970

See accompanying notes to financial statements.

5.