Page 301 - Onboarding May 2017

P. 301

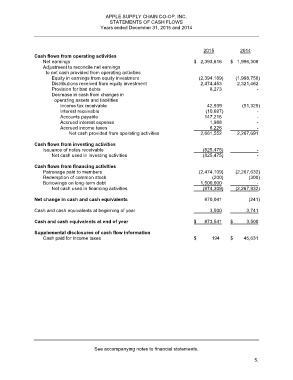

APPLE SUPPLY CHAIN CO-OP, INC.

STATEMENTS OF CASH FLOWS

Years ended December 31, 2015 and 2014

2015 2014

Cash flows from operating activities

Net earnings $ 2,393,616 $ 1,996,308

Adjustment to reconcile net earnings

to net cash provided from operating activities

Equity in earnings from equity investment (2,394,189) (1,998,750)

Distributions received from equity investment 2,474,453 2,321,462

Provision for bad debts 8,273 -

Decrease in cash from changes in

operating assets and liabilities

Income tax receivable 42,939 (51,329)

Interest receivable (10,697) -

Accounts payable 147,216 -

Accrued interest expense 1,988 -

Accrued income taxes 6,226 -

Net cash provided from operating activities 2,661,552 2,267,691

Cash flows from investing activities

Issuance of notes receivable (825,475) -

Net cash used in investing activities (825,475) -

Cash flows from financing activities

Patronage paid to members (2,474,109) (2,267,632)

Redemption of common stock (200) (300)

Borrowings on long-term debt 1,500,000 -

Net cash used in financing activities (974,309) (2,267,932)

Net change in cash and cash equivalents 870,041 (241)

Cash and cash equivalents at beginning of year 3,500 3,741

Cash and cash equivalents at end of year $ 873,541 $ 3,500

Supplemental disclosures of cash flow information

Cash paid for income taxes $ 194 $ 45,631

See accompanying notes to financial statements.

5.