Page 12 - Buyer's Guide

P. 12

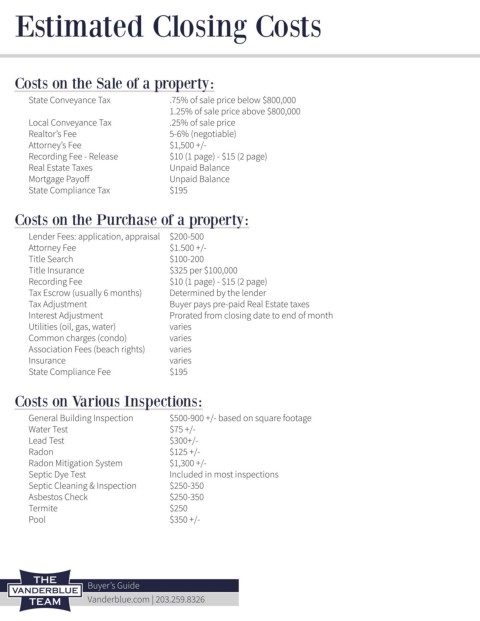

Estimated Closing Costs

Costs on the Sale of a property:

State Conveyance Tax .75% of sale price below $800,000

1.25% of sale price above $800,000

Local Conveyance Tax .25% of sale price

Realtor’s Fee 5-6% (negotiable)

Attorney’s Fee $1,500 +/-

Recording Fee - Release $10 (1 page) - $15 (2 page)

Real Estate Taxes Unpaid Balance

Mortgage Payoff Unpaid Balance

State Compliance Tax $195

Costs on the Purchase of a property:

Lender Fees: application, appraisal $200-500

Attorney Fee $1.500 +/-

Title Search $100-200

Title Insurance $325 per $100,000

Recording Fee $10 (1 page) - $15 (2 page)

Tax Escrow (usually 6 months) Determined by the lender

Tax Adjustment Buyer pays pre-paid Real Estate taxes

Interest Adjustment Prorated from closing date to end of month

Utilities (oil, gas, water) varies

Common charges (condo) varies

Association Fees (beach rights) varies

Insurance varies

State Compliance Fee $195

Costs on Various Inspections:

General Building Inspection $500-900 +/- based on square footage

Water Test $75 +/-

Lead Test $300+/-

Radon $125 +/-

Radon Mitigation System $1,300 +/-

Septic Dye Test Included in most inspections

Septic Cleaning & Inspection $250-350

Asbestos Check $250-350

Termite $250

Pool $350 +/-

Buyer’s Guide

Vanderblue.com | 203.259.8326