Page 37 - Module 5 - Key_Players_in_the_financial_game

P. 37

Module 5 – Understanding the game between the bulls and bears

34.5 Going lower than that will be placing more odds against you, you can use H4 or H1 for scalping, but

I will never do that. But each trader will decide, but whatever you decide, forward test it hundreds of

trades. Don't back test, you will see what you want to see.

34.6 If price is at a higher timeframe supply (D1, WK or Monthly), don't go long. Wait patiently for a short

setup, either set & forget at an original and fresh supply level on H1/H4, OR wait for a brand-new

level of supply to be formed and sell the pullback. Opposite for higher timeframe demand.

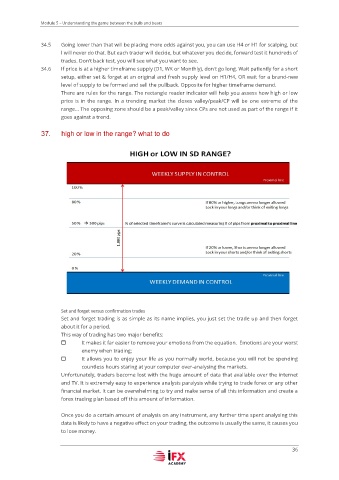

There are rules for the range. The rectangle reader indicator will help you assess how high or low

price is in the range. In a trending market the closes valley/peak/CP will be one extreme of the

range... The opposing zone should be a peak/valley since CPs are not used as part of the range if it

goes against a trend.

high or low in the range? what to do

Set and forget versus confirmation trades

Set and forget trading is as simple as its name implies, you just set the trade up and then forget

about it for a period.

This way of trading has two major benefits:

It makes it far easier to remove your emotions from the equation. Emotions are your worst

enemy when trading;

It allows you to enjoy your life as you normally world, because you will not be spending

countless hours staring at your computer over-analysing the markets.

Unfortunately, traders become lost with the huge amount of data that available over the internet

and TV. It is extremely easy to experience analysis paralysis while trying to trade forex or any other

financial market. It can be overwhelming to try and make sense of all this information and create a

forex trading plan based off this amount of information.

Once you do a certain amount of analysis on any instrument, any further time spent analysing this

data is likely to have a negative effect on your trading, the outcome is usually the same, it causes you

to lose money.

36