Page 45 - Module1_Introduction_to_the_Forex_Environment

P. 45

Module 1 – Lesson 9 – How do traders make money

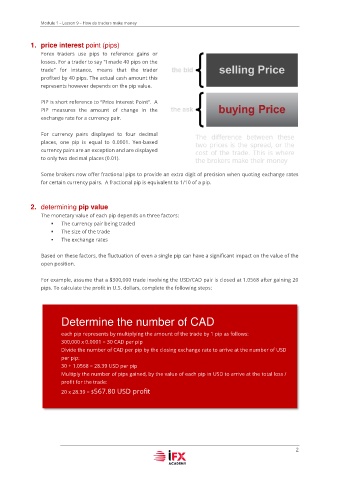

1. price interest point (pips)

Forex traders use pips to reference gains or

losses. For a trader to say "I made 40 pips on the

trade" for instance, means that the trader

profited by 40 pips. The actual cash amount this

represents however depends on the pip value.

PIP is short reference to “Price Interest Point”. A

PIP measures the amount of change in the

exchange rate for a currency pair.

For currency pairs displayed to four decimal

places, one pip is equal to 0.0001. Yen-based

currency pairs are an exception and are displayed

to only two decimal places (0.01).

Some brokers now offer fractional pips to provide an extra digit of precision when quoting exchange rates

for certain currency pairs. A fractional pip is equivalent to 1/10 of a pip.

2. determining pip value

The monetary value of each pip depends on three factors:

▪ The currency pair being traded

▪ The size of the trade

▪ The exchange rates

Based on these factors, the fluctuation of even a single pip can have a significant impact on the value of the

open position.

For example, assume that a $300,000 trade involving the USD/CAD pair is closed at 1.0568 after gaining 20

pips. To calculate the profit in U.S. dollars, complete the following steps:

Determine the number of CAD

each pip represents by multiplying the amount of the trade by 1 pip as follows:

300,000 x 0.0001 = 30 CAD per pip

Divide the number of CAD per pip by the closing exchange rate to arrive at the number of USD

per pip:

30 ÷ 1.0568 = 28.39 USD per pip

Multiply the number of pips gained, by the value of each pip in USD to arrive at the total loss /

profit for the trade:

20 x 28.39 = $567.80 USD profit

2