Page 4 - Module 12 Consolidation

P. 4

Module 11 – The Fibonacci Science

3. the breakout

The Forex is traded around the world; however, its primary volatility is in 3 markets: The United

States, Europe and Asia. The European market starts to become active around 2:00 a.m. EST. it closes

at 11:00 a.m. EST. the United States activity begins at 8:00 a.m. EST and ends around 4:00 p.m. EST.

Asia opens around 6:00 p.m. and closes at 4:00 a.m.

Since the markets are driven by fear and greed, which are two very dominate emotions, they move

where the greatest demand is. When the market is spooked, from an event or fundamental

announcement, that rapid initial move is called a breakout. A breakout is when the market is calm

and bracketed, going up and down, hitting and bouncing off of support and resistance yet going

nowhere, and then a rapid, volatile, aggressive, move takes place and the market takes off in a

direction, blowing out the high or low.

Breakouts often occur on fundamental announcement days. That is usually when the market is most

volatile. However, there are breakouts on non-fundamental days. When the market breaks out, and

your order is executed, your strategy could be to follow it with stop orders, locking in profit or you

can limit out, at a projected profit. Remember, when prices break out they will not go forever.

4. straddling the market in anticipation of a breakout

If you look at the times when the 3 major markets open, sometimes you will see the breakouts during

their trading session. You will see that shortly after the sessions open, the market may break out in

a direction, up or down. One thing we don’t know is in which direction it will occur.

To effectively trade using a Straddle, you should see at least 6 hours of consolidation and a

fundamental announcement about to be released to avoid a bull or bear trap. The basic strategy is

to enter long if prices breakout above resistance or enter short if prices breakout below support.

When the market makes up its mind which way it is going, and you are taken in either long or short,

you immediately cancel the opposing trade and look to lock in profit. Straddling the market allows

you to get in at the beginning of the breakout, not in the middle or at the end. As the market moves

in your direction, move your stop as quickly as possible to your break-even position.

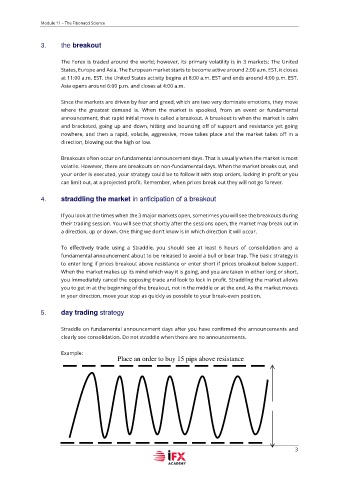

5. day trading strategy

Straddle on fundamental announcement days after you have confirmed the announcements and

clearly see consolidation. Do not straddle when there are no announcements.

Example:

Place an order to buy 15 pips above resistance

3