Page 13 - LITRG_PA-final-2018

P. 13

Tax employment status

For tax purposes, you need to understand whether your personal assistant is an

employee or self-employed.

Tax employment status is very important. It affects the type of tax and National

Insurance contributions a person pays and how they pay them. Employed and

self-employed people pay different tax and National Insurance contributions.

If tax employment status is wrong, it may mean the wrong amount and/or type

of tax and National Insurance contributions are being paid.

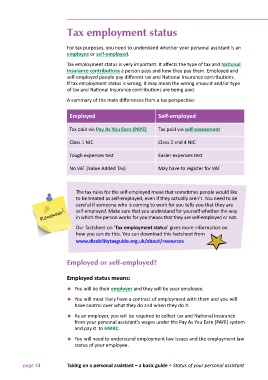

A summary of the main differences from a tax perspective:

Employed Self-employed

Tax paid via Pay As You Earn (PAYE) Tax paid via self-assessment

Class 1 NIC Class 2 and 4 NIC

Tough expenses test Easier expenses test

No VAT (Value Added Tax) May have to register for VAT

The tax rules for the self-employed mean that sometimes people would like

to be treated as self-employed, even if they actually aren’t. You need to be

careful if someone who is coming to work for you tells you that they are

self-employed. Make sure that you understand for yourself whether the way

in which the person works for you means that they are self-employed or not.

Our factsheet on ‘Tax employment status’ gives more information on

how you can do this. You can download this factsheet from

www.disabilitytaxguide.org.uk/about/resources

Employed or self-employed?

Employed status means:

• You will be their employer and they will be your employee.

• You will most likely have a contract of employment with them and you will

have control over what they do and when they do it.

• As an employer, you will be required to collect tax and National Insurance

from your personal assistant’s wages under the Pay As You Earn (PAYE) system

and pay it to HMRC.

• You will need to understand employment law issues and the employment law

status of your employee.

page 13 Taking on a personal assistant – a basic guide • Status of your personal assistant