Page 475 - Manual Of Operating Practices For Trade Remedy Investigations

P. 475

Manual of OP for Trade Remedy Investigations

(7A) The provisions of the Customs Act, 1962 (52 of 1962) and the rules and

regulations made thereunder, relating to the date for determination of rate

of duty, assessment, non-levy, short-levy, refunds, interest, appeals, offences

and penalties shall, as far as may be, apply to the duty chargeable under this

section as they apply in relation to duties leviable under that Act].

(8) Every notification issued under this section shall, as soon as may be after it

is issued, be laid before each House of Parliament.”

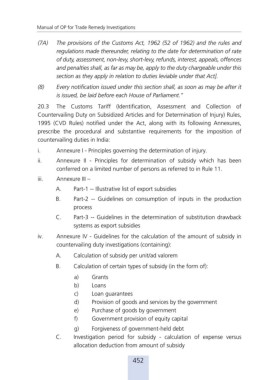

20.3 The Customs Tariff (Identification, Assessment and Collection of

Countervailing Duty on Subsidized Articles and for Determination of Injury) Rules,

1995 (CVD Rules) notified under the Act, along with its following Annexures,

prescribe the procedural and substantive requirements for the imposition of

countervailing duties in India:

i. Annexure I - Principles governing the determination of injury.

ii. Annexure II - Principles for determination of subsidy which has been

conferred on a limited number of persons as referred to in Rule 11.

iii. Annexure III –

A. Part-1 -- Illustrative list of export subsidies

B. Part-2 -- Guidelines on consumption of inputs in the production

process

C. Part-3 -- Guidelines in the determination of substitution drawback

systems as export subsidies

iv. Annexure IV - Guidelines for the calculation of the amount of subsidy in

countervailing duty investigations (containing):

A. Calculation of subsidy per unit/ad valorem

B. Calculation of certain types of subsidy (in the form of):

a) Grants

b) Loans

c) Loan guarantees

d) Provision of goods and services by the government

e) Purchase of goods by government

f) Government provision of equity capital

g) Forgiveness of government-held debt

C. Investigation period for subsidy - calculation of expense versus

allocation deduction from amount of subsidy

452