Page 15 - PNMRT AnnRpt 2020

P. 15

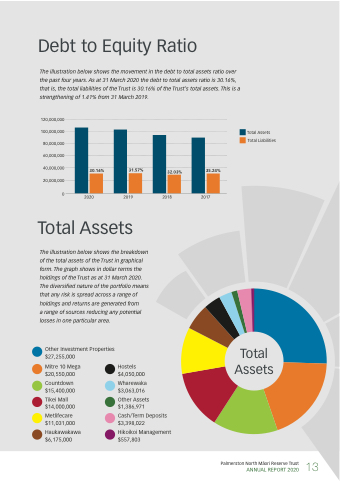

Debt to Equity Ratio

The illustration below shows the movement in the debt to total assets ratio over the past four years. As at 31 March 2020 the debt to total assets ratio is 30.16%, that is, the total liabilities of the Trust is 30.16% of the Trust’s total assets. This is a strengthening of 1.41% from 31 March 2019.

120,000,000 100,000,000 80,000,000 60,000,000 40,000,000 20,000,000 0

Total Assets Total Liabilities

35.24%

2020 2019 2018 2017

30.16%

31.57%

32.03%

Total Assets

The illustration below shows the breakdown of the total assets of the Trust in graphical form. The graph shows in dollar terms the holdings of the Trust as at 31 March 2020. The diversified nature of the portfolio means that any risk is spread across a range of holdings and returns are generated from

a range of sources reducing any potential losses in one particular area.

Other Investment Properties $27,255,000

Mitre 10 Mega $20,550,000

Countdown $15,400,000

Tikei Mall $14,000,000

Metlifecare $11,031,000

Haukawakawa $6,175,000

Hostels $4,050,000

Wharewaka $3,063,016

Other Assets $1,386,971

Cash/Term Deposits $3,398,022

Hikoikoi Management $557,803

Total Assets

Palmerston North Ma¯ori Reserve Trust

13

ANNUAL REPORT 2020