Page 47 - UKRRptJul22

P. 47

of the invasion, but last week it signalled it could resume regular monetary policy reviews as business activity partially recovered in safer parts of the country.

It is betting that a sharp rate hike will also nudge the government to raise the yield on domestic bonds, making hryvnia assets more attractive and preventing household incomes and savings from being eroded by inflation.

The central bank has fixed the hryvnia exchange rate, which has forced it to sell billions of dollars in forex reserves since the start of the invasion. It aims to let the currency float freely eventually once conditions allow.

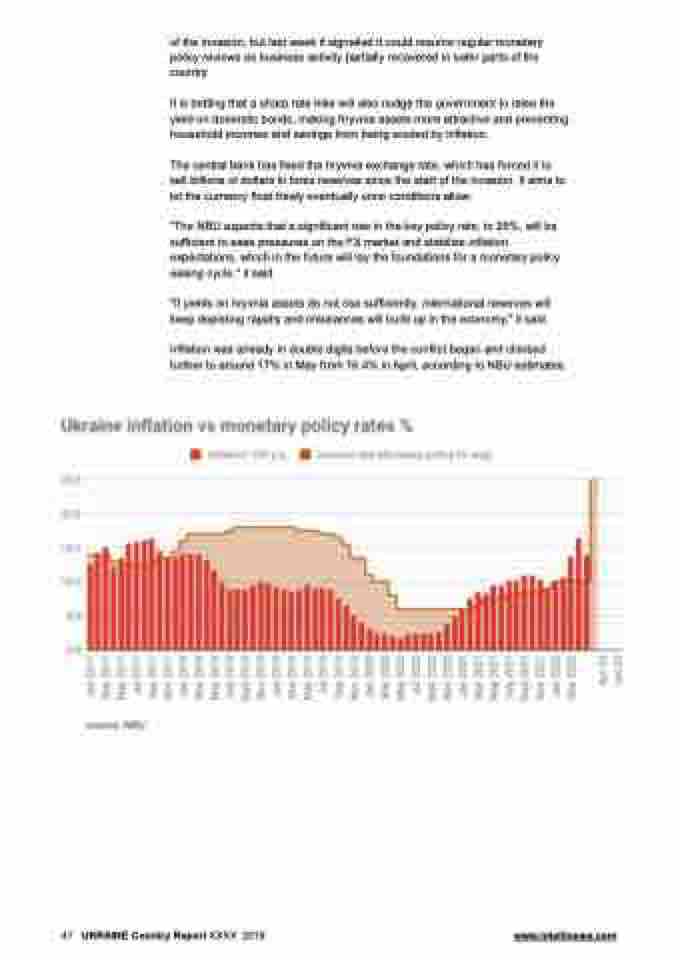

"The NBU expects that a significant rise in the key policy rate, to 25%, will be sufficient to ease pressures on the FX market and stabilize inflation expectations, which in the future will lay the foundations for a monetary policy easing cycle," it said.

"If yields on hryvnia assets do not rise sufficiently, international reserves will keep depleting rapidly and imbalances will build up in the economy," it said.

Inflation was already in double digits before the conflict began and climbed further to around 17% in May from 16.4% in April, according to NBU estimates.

47 UKRAINE Country Report XXXX 2018 www.intellinews.com