Page 49 - UKRRptJul22

P. 49

S&P last upgraded Ukraine’s rating from Caa2 (positive) in August 2017. The rating nadir was Ca (negative) awarded in March 2015 following the Maidan events. Its zenith was B1 (positive) awarded in August 2008 at the apex of the region-wide boom.

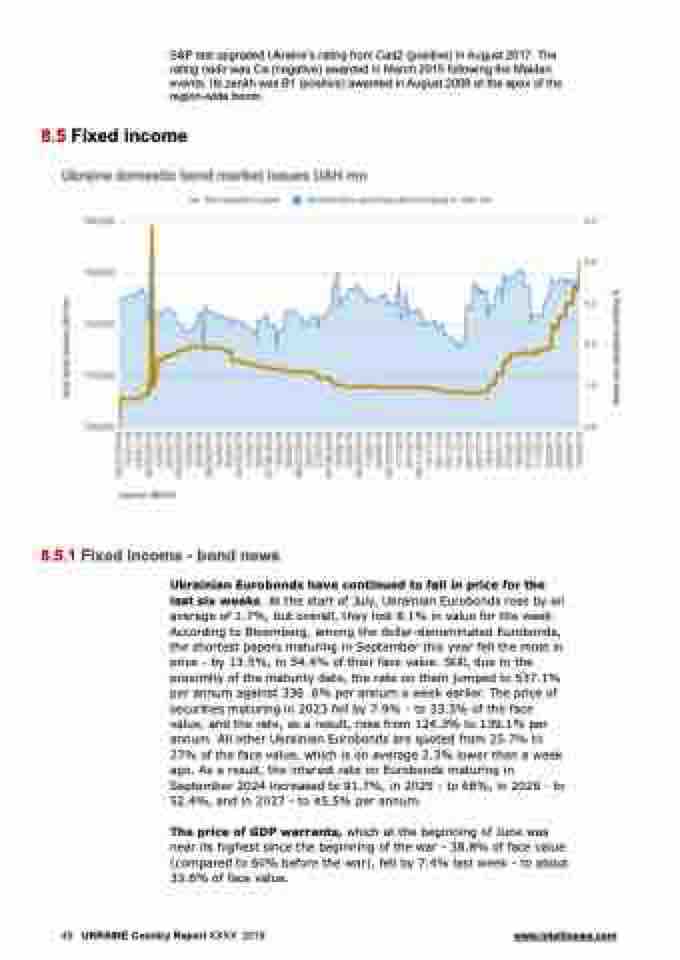

8.5 Fixed income

8.5.1 Fixed income - bond news

Ukrainian Eurobonds have continued to fall in price for the last six weeks. At the start of July, Ukrainian Eurobonds rose by an average of 1.7%, but overall, they lost 8.1% in value for the week. According to Bloomberg, among the dollar-denominated Eurobonds, the shortest papers maturing in September this year fell the most in price - by 13.5%, to 54.4% of their face value. Still, due to the proximity of the maturity date, the rate on them jumped to 537.1% per annum against 336 .6% per annum a week earlier. The price of securities maturing in 2023 fell by 7.9% - to 33.3% of the face value, and the rate, as a result, rose from 124.3% to 139.1% per annum. All other Ukrainian Eurobonds are quoted from 25.7% to 27% of the face value, which is on average 2.3% lower than a week ago. As a result, the interest rate on Eurobonds maturing in September 2024 increased to 91.7%, in 2025 - to 66%, in 2026 - to 52.4%, and in 2027 - to 45.5% per annum.

The price of GDP warrants, which at the beginning of June was near its highest since the beginning of the war - 38.8% of face value (compared to 60% before the war), fell by 7.4% last week - to about 33.6% of face value.

49 UKRAINE Country Report XXXX 2018 www.intellinews.com